The Adani Group has responded and issued a statement addressing the recent bribery charges filed by the US Department of Justice (DOJ) and the Securities and Exchange Commission (SEC).

The charges accuse Gautam Adani and other executives of orchestrating a $250 million bribery scheme to secure high-value solar energy contracts. Following these allegations, the Adani Group has decided to cancel its $600 million bond offering.

Impact on Adani Group’s Shares and Bonds

The charges have had a considerable impact on the Adani Group’s financial standing. Shares of Adani Group companies have plummeted by up to 20%, with Adani Green Energy experiencing an 18% drop on the Bombay Stock Exchange (BSE).

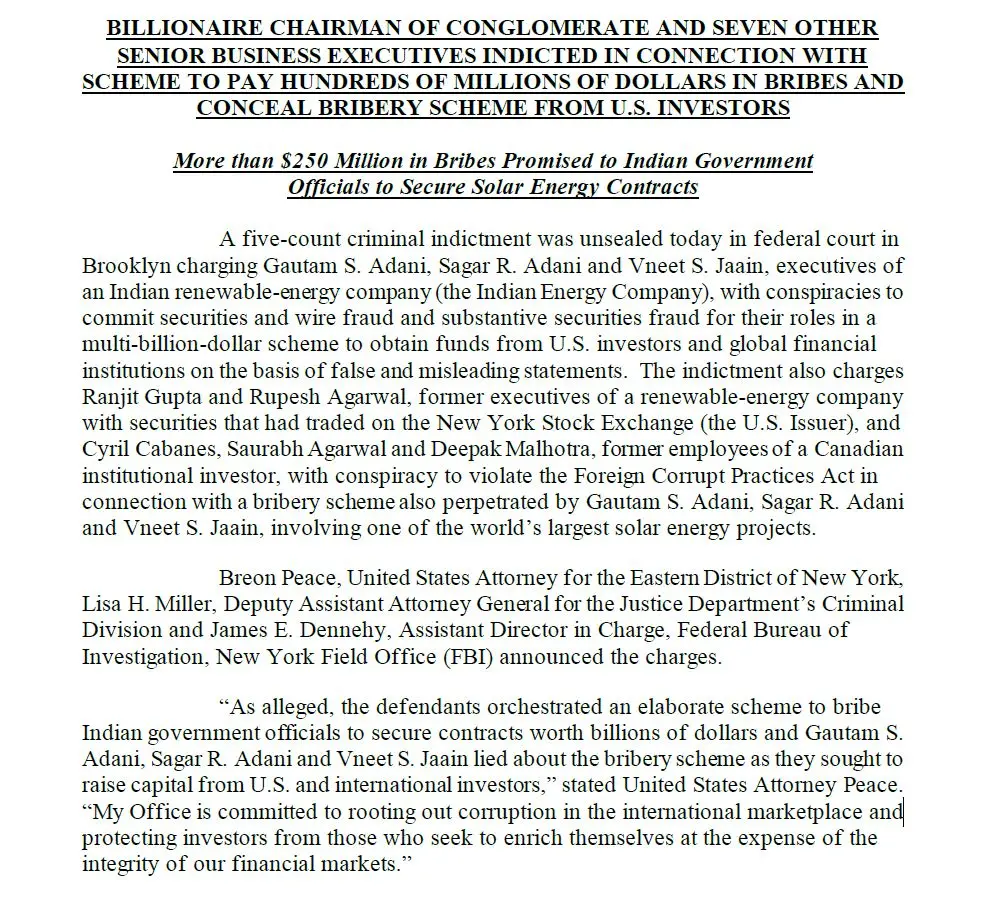

🚨🚨 Gautam Adani charged by US over alleged $250 million bribe plot.

Here's what US District Court says on Adani Group👇

– Approx b/w 2020 & 2024, over $250 mn in bribes were promised by #Adani Group to Indian govt officials for solar energy contracts

–#GautamAdani personally… pic.twitter.com/jtNPGcJjSd

— Moneycontrol (@moneycontrolcom) November 21, 2024

Additionally, Adani’s US dollar bonds have seen a sharp decline in Asian trading, with some securities falling as much as 15 cents, reported India Today.

Official Statement from Adani Green Energy

In an official statement, Adani Green Energy responded to the charges: “The United States Department of Justice and the United States Securities and Exchange Commission have issued a criminal indictment and brought a civil complaint, respectively, in the United States District Court for the Eastern District of New York, against our Board members, Gautam Adani and Sagar Adani.

The United States Department of Justice has also included our Board member, Vneet Jaain, in such criminal indictment. In light of these developments, our subsidiaries have presently decided not to proceed with the proposed USD-denominated bond offerings”.

Stock Prices of Adani Group Companies

Adani Enterprises Ltd (ADANIENT) saw its shares drop by 23%, currently trading at ₹2,208.

Adani Green Energy Ltd (ADANIGREEN): Shares fell by 18%, trading at ₹1,152.85.

Adani Ports and Special Economic Zone Ltd (ADANIPORTS): Shares are down 20%, trading at ₹1,031.7.

Adani Energy Solutions: Shares tanked 20%, reaching ₹697.25.

ADANI GROUP STOCKS IN FOCUS

PIC SOURCE @StocktwitsIndia pic.twitter.com/wBgMhPQdpn

— RedboxGlobal India (@REDBOXINDIA) November 21, 2024

Market Reactions and Future Outlook

The indictment has added to the Adani Group’s challenges, following a tumultuous period since 2023 when the Hindenburg Research report accused the group of stock manipulation and fraud, erasing $150 billion in market value.

Mohit Mirpuri, a fund manager at Singapore-based SGMC Capital, commented, “While Adani weathered the Hindenburg allegations, these charges highlight ongoing governance and regulatory risks”.