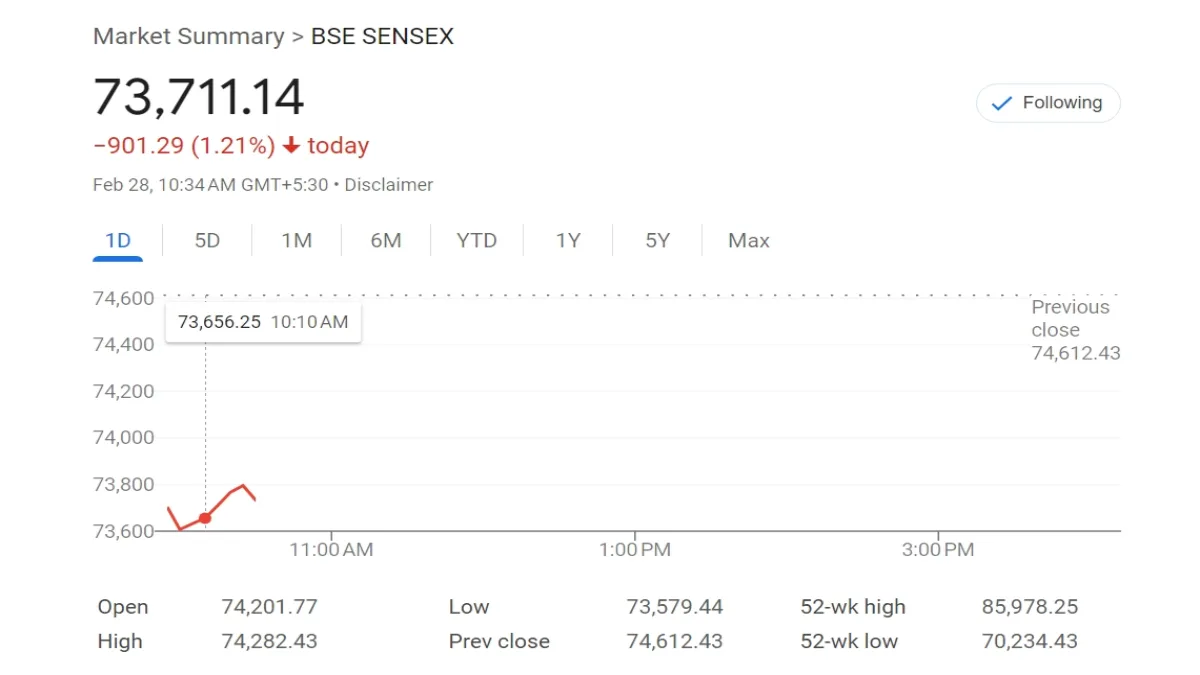

The Indian stock market experienced a substantial downturn on the penultimate day of the month, February 28, 2025. The Sensex crashed by 1,000 points and the Nifty fell below 22,300. This sharp decline has left investors concerned and searching for answers.

The Sensex dropped by 1.32%, or 985.54 points, reaching an intraday low of 73,658.45. At the same time, the Nifty50 decreased by 1.31%, or 295.95 points, hitting an intraday low of 22,249.10.

The combined market capitalization of all listed companies on the BSE dived by Rs 7.16 lakh crore, bringing the total to Rs 385.94 lakh crore.

Early trading saw the Nifty IT index stocks decline by as much as 4%, mirroring overnight losses on Wall Street triggered by a downturn in chipmaker Nvidia. Among the top losers were Persistent Systems, Tech Mahindra, and Mphasis.

Here are five key reasons behind today’s stock market fall.

1. Global Tariff Concerns Impacting Investor Sentiment

The recent announcement of tariffs by President Trump on goods from Mexico, Canada, and China has created uncertainty in global markets. These tariffs have raised concerns about potential trade wars, leading to a negative impact on investor sentiment.

2. Ongoing Foreign Institutional Investor (FII) Selling

Foreign Institutional Investors (FIIs) have been consistently selling off their holdings in the Indian market. This continued selling pressure has contributed to the decline in both the Sensex and Nifty indices.

Top Losers in the Stock Market Today

Here are the top losers in the stock market today, along with their loss percentage and current price:

- Hindalco Industries

- Loss Percentage: 6.45%

- Current Price: ₹619.45

- Vedanta

- Loss Percentage: 5.25%

- Current Price: ₹409.25

- Dr. Reddy’s Laboratories

- Loss Percentage: 4.15%

- Current Price: ₹1,128.15

- Bajaj Holdings & Investment

- Loss Percentage: 3.85%

- Current Price: ₹11,642.05

- JSW Energy

- Loss Percentage: 3.75%

- Current Price: ₹467.25

3. Weak Global Cues Affecting Domestic Markets

Weak global cues, including a decline in major international indices, have also played a role in today’s market crash. The negative performance of global markets has influenced investor behavior in India.

Promoters of Nifty50 firms are offloading their stakes at an unprecedented pace, with ownership sinking to a 22-year low of 41.1% in the December quarter.

May be promoters are booking profits, according to the Finance Minister!!!#StockMarketCrash pic.twitter.com/1hfNb5BPVt— Pritesh Shah (@priteshshah_) February 28, 2025

4. Concerns Over Economic Slowdown

There are growing concerns about a potential economic slowdown, both globally and domestically. These concerns have led to cautious investor behavior, further exacerbating the market decline, reported The Economic Times.

5. Sector-Specific Weaknesses

Certain sectors, such as IT and banking, have shown significant weaknesses in recent trading sessions. The decline in these sectors has had a ripple effect on the overall market performance.