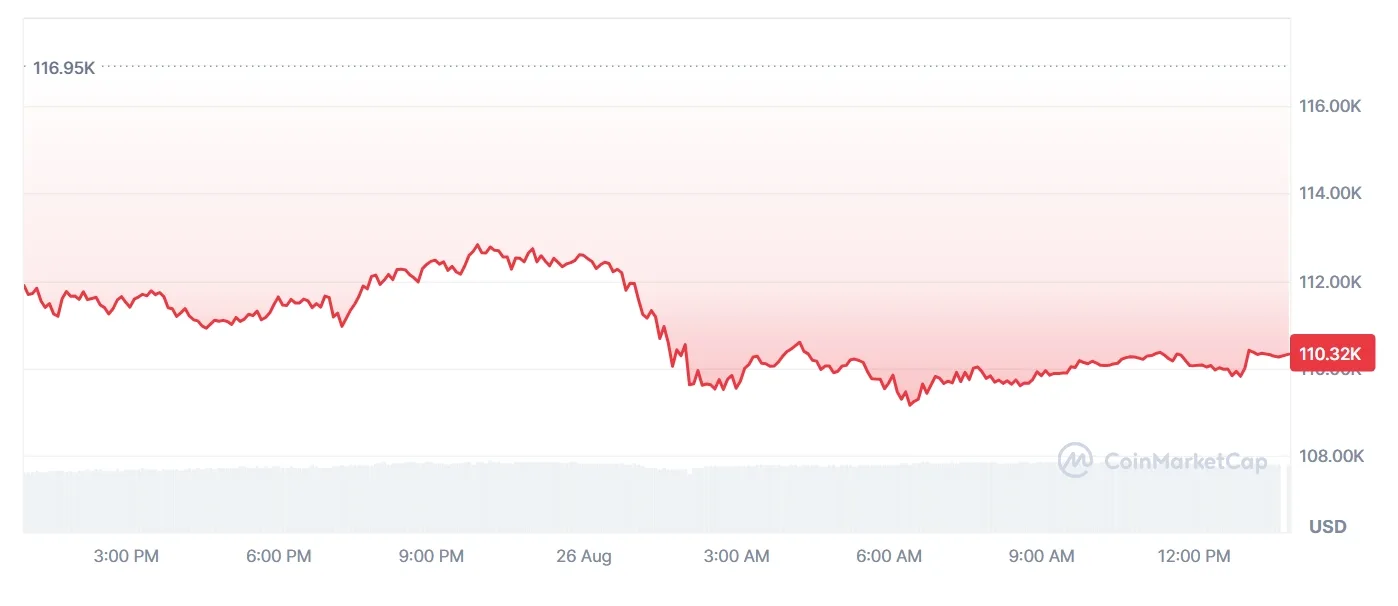

In a brutal market flush early Tuesday, Bitcoin plunged to a seven-week low of $109,000, rattling investor confidence and triggering over $930 million in liquidations across the crypto ecosystem.

The sell-off was sparked by a Bitcoin whale unloading 24,000 BTC, valued at approximately $2.7 billion, during Asian trading hours. The massive dump sent shockwaves through exchanges, causing leveraged long positions to collapse and dragging the broader crypto market down by nearly 9%.

“Historically, failure to hold above this level has often led to multi-month market weakness and potential deeper corrections,” warned blockchain analytics firm Glassnode, noting that Bitcoin had dipped below the average cost basis of recent investors.

Altcoins Follow Suit

Altcoins bore the brunt of the correction, with Solana dropping over 11% to $186, Dogecoin sliding 10% to $0.21, and Cardano falling 9% to $0.83. Ethereum, despite a 7% dip, showed signs of recovery, trading above $4,400 at press time.

“It never feels good when you buy the dip. The dip comes when sentiment drops,” said Matt Hougan, CIO of Bitwise, advising investors to stay disciplined amid volatility.

Market Outlook

The total crypto market cap fell to $3.84 trillion, its lowest since August 6. Analysts suggest that if the correction deepens, Bitcoin could retreat to $87,000 before resuming its bull run.

Alongside Bitcoin’s plunge, several major altcoins suffered sharp declines on August 26, 2025. Ethereum dropped over 7.5%, slipping below its key support at $4,350, while XRP, Solana (SOL), and Chainlink (LINK) each fell by more than 8%.

Cardano (ADA) and TRON (TRX) lost between 4–7%, and meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) tumbled over 5% and 4%, respectively.

The widespread correction erased billions in market value, with over $930 million in liquidations, as leveraged positions collapsed under selling pressure

Despite the downturn, some experts view this as a healthy reset within a broader sideways channel, with potential for long-term accumulation.