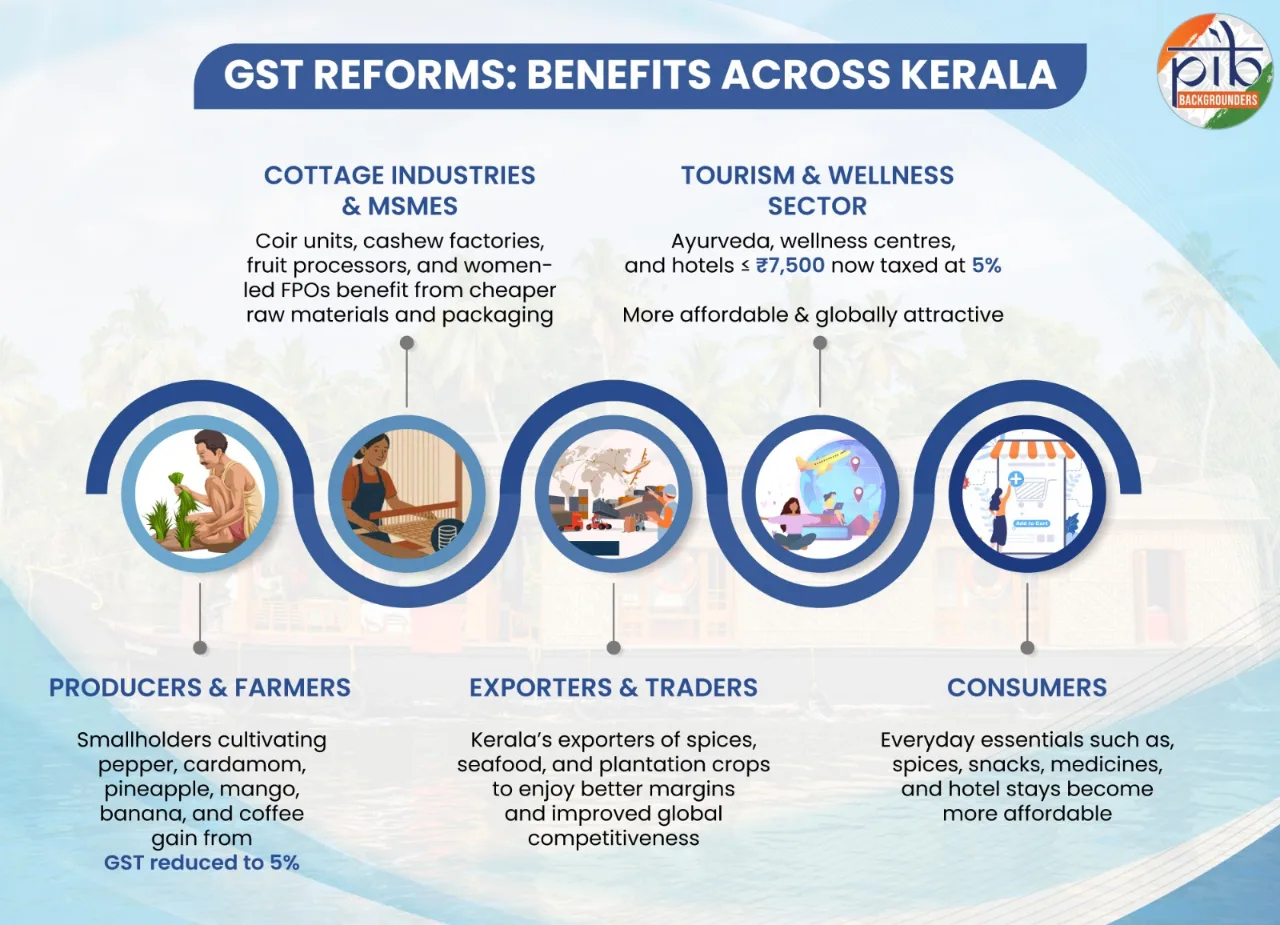

Kochi, Kerala: In a sweeping reform that’s set to reshape Kerala’s economic landscape, the latest GST rate reductions are breathing new life into the state’s traditional industries—from spice gardens and seafood hubs to Ayurveda retreats and coir factories.

The move, announced by the Government of India, slashes GST rates to 5% across a wide range of goods and services, directly impacting millions of workers and small-scale producers.

Cashew, Coir & Coffee: Relief for Kerala’s Backbone

Kerala’s famed Kollam cashew corridor, employing over 3 lakh workers, will now benefit from a reduced GST rate of 5% on roasted, salted, and coated nuts.

This change is expected to lower production costs by up to 11%, boosting margins for micro-units and cooperatives. Similarly, the coir sector—concentrated in Alappuzha and Kollam—enjoys a major win, with 3.7 lakh workers (80% of whom are women) benefiting from reduced costs on GI-tagged mats, ropes, and geotextiles.

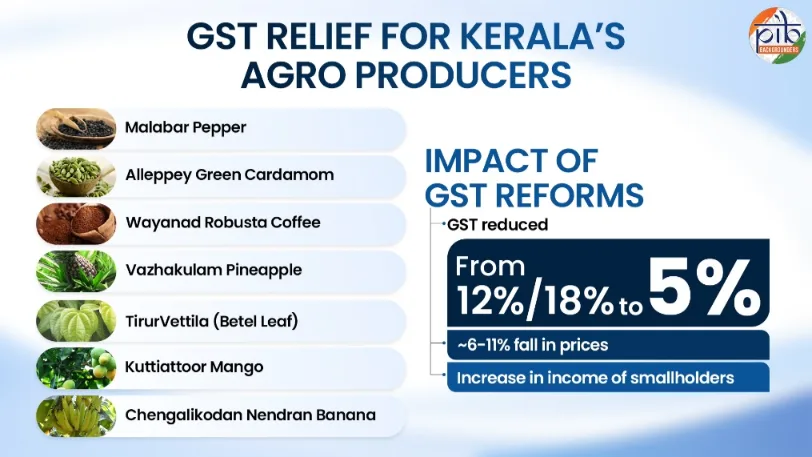

Wayanad’s Robusta coffee farmers, many of whom are smallholders, will also benefit from the GST cut on instant coffee mixes. With Kerala contributing over 70,000 metric tons of coffee annually, this move enhances export competitiveness and supports 50,000 workers in the sector, according to the PIB Press Release.

Spice Belt Gets a Boost

Kerala’s spice economy, anchored by GI-tagged products like Malabar Pepper, Alleppey Green Cardamom, and packed spice mixes, is set to thrive under the new tax regime.

With GST rates dropping from 18% to 5%, costs across the spice value chain are expected to fall by 11%, making Kerala’s exports more attractive to global buyers and improving income security for smallholder farmers and seasonal laborers.

Coastal Communities Celebrate

The fisheries sector, supporting over 1 million fisherfolk, will see a 6–11% cost reduction on processed seafood. With Kerala exporting over ₹8,285 crore worth of marine products last year, the GST cut is poised to enhance global competitiveness and stabilize incomes in coastal districts like Kochi, Kannur, and Kollam.

Fruit & Wellness Industries Thrive

From Vazhakulam pineapples to Kuttiattoor mangoes, Kerala’s fruit processing clusters are set to benefit from reduced GST on jams, pulp, and pickles. The food processing sector, which employs nearly 30% of Kerala’s workforce, will see lower input costs and higher margins.

Meanwhile, the tourism and Ayurveda sectors—cornerstones of Kerala’s global identity—are now taxed at just 5%. This makes homestays, wellness packages, and Ayurvedic treatments more affordable for domestic and international visitors, boosting Kerala’s appeal as a holistic travel destination.

Inclusive Growth for Every Corner

Whether it’s the weaver in Alappuzha, the fisherwoman in Kollam, or the orchard owner in Kannur, the GST reforms promise inclusive growth across Kerala’s diverse economic fabric.

By lowering costs and expanding market access, the new structure empowers smallholders, MSMEs, and cooperatives to thrive in both domestic and export markets.

Kerala’s economy isn’t just growing—it’s evolving, with tradition and innovation walking hand in hand.

Explore more official announcements in our Press Release section.