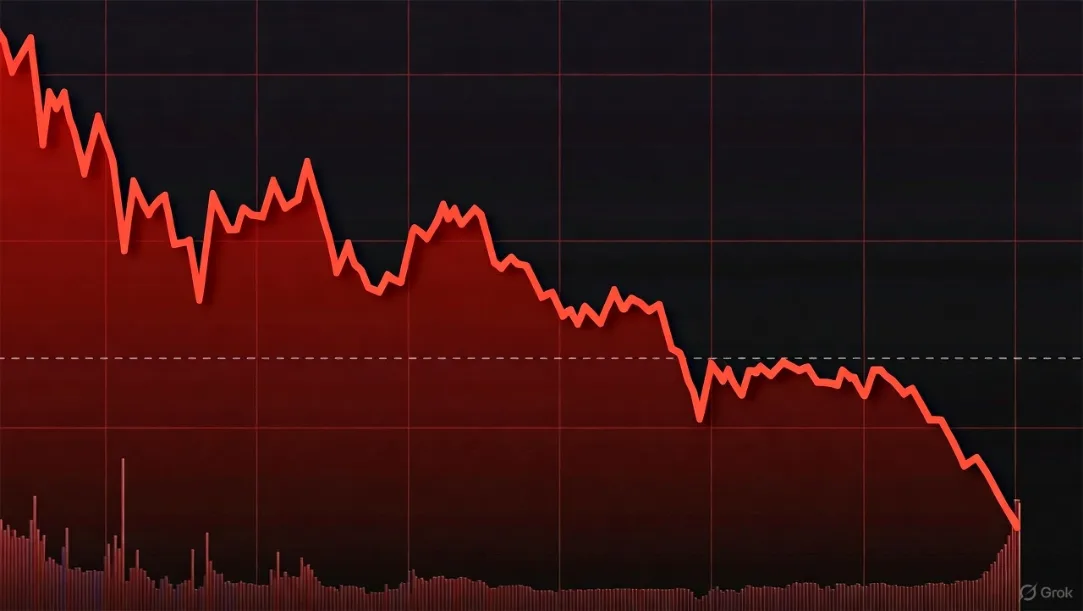

The Dow drops 500 points as U.S.-China trade tensions mount, rattling investors and erasing recent gains on Wall Street. On October 14, 2025, the blue-chip index closed at 45,620.31 after shedding 504 points, or 1.1%, amid fears of a full-blown trade war. This sharp decline follows President Trump’s threat of 100% tariffs on Chinese imports, sparking a global sell-off that wiped out billions in market value.

However, the turmoil started late last week when Trump announced the tariffs in response to China’s tightened controls on rare earth minerals, which make up 70% of global supply. Beijing hit back with sanctions on U.S. shipping units, intensifying the standoff. Investors worry this could disrupt supply chains and slow economic growth, especially with the U.S. election looming.

US-China Trade Tensions Spark Widespread Sell-Off

Markets reacted swiftly to the escalating dispute. The S&P 500 fell 1.3%, closing at 6,573.41 after losing 81 points, while the Nasdaq Composite dropped nearly 2%, shedding 408 points to end at 22,286.04. Tech stocks took the hardest hit, with Nvidia and Tesla plunging 3.6% to 4.8%, as they rely heavily on Chinese components.

Additionally, the CBOE Volatility Index, known as Wall Street’s “fear gauge,” spiked above 22—a four-month high—signaling heightened anxiety. Crypto markets also suffered, with Bitcoin dropping 3.7% to $110,500 and the sector losing $150 billion overall. Meanwhile, oil prices slid 2%, with Brent crude at $61.93 a barrel, as traders weighed trade risks against steady demand. Globally, the Australian dollar fell 1%, and Asia’s MSCI index dropped for a third day, highlighting the ripple effects.

Expert Warnings as Dow Drops 500 Points Persist

Analysts point to ongoing risks. “The sell-off has the potential to evolve into a larger correction, especially if the US-China trade truce is over,” said Michael O’Rourke, chief market strategist at JonesTrading.

Wall Street Sinks as Trade War Fears Intensify 🇺🇸 Stocks opened sharply lower in New York on Tuesday as escalating US-China trade tensions reignited investor anxiety and triggered a broad market sell-off.

The Dow Jones Industrial Average dropped 501 points, or 1.1%, to 45,566,… https://t.co/a9eNGMuwHp pic.twitter.com/OBnAo7GQw7

— Share_Talk ™ (@Share_Talk) October 14, 2025

Notably, Trump stated on social media, “There is no way that China should be allowed to hold the World ‘captive’ over rare earth exports.” Ulrike Hoffmann-Burchardi, global head of equities at UBS Global Wealth Management, added, “Trade policy remains a key driver for US financial markets this year, and last week saw a sharp re-escalation in tensions between the US and China.”

This comes after Friday’s 800-point Dow plunge, with Monday’s rebound now fully reversed. As third-quarter earnings roll in from banks like JPMorgan, focus shifts to how trade woes might dent profits.

Broader Impacts of Mounting US-China Trade Tensions

The feud revives memories of 2018-2019 trade wars, which cost the U.S. economy $1.7 trillion in stock value. Today, with AI and chip sectors booming, disruptions could hit harder. China controls key minerals for electronics and EVs, potentially raising costs for consumers.

Furthermore, this timing aligns with Gaza peace deals easing oil fears, but trade uncertainty overshadows positives. Investors eye November 1 tariff deadlines, with some betting on negotiations to cool tensions.

In summary, as the Dow drops 500 points, US-China trade tensions mount and threaten stability. Markets remain volatile, urging caution amid these trending geopolitical shifts.