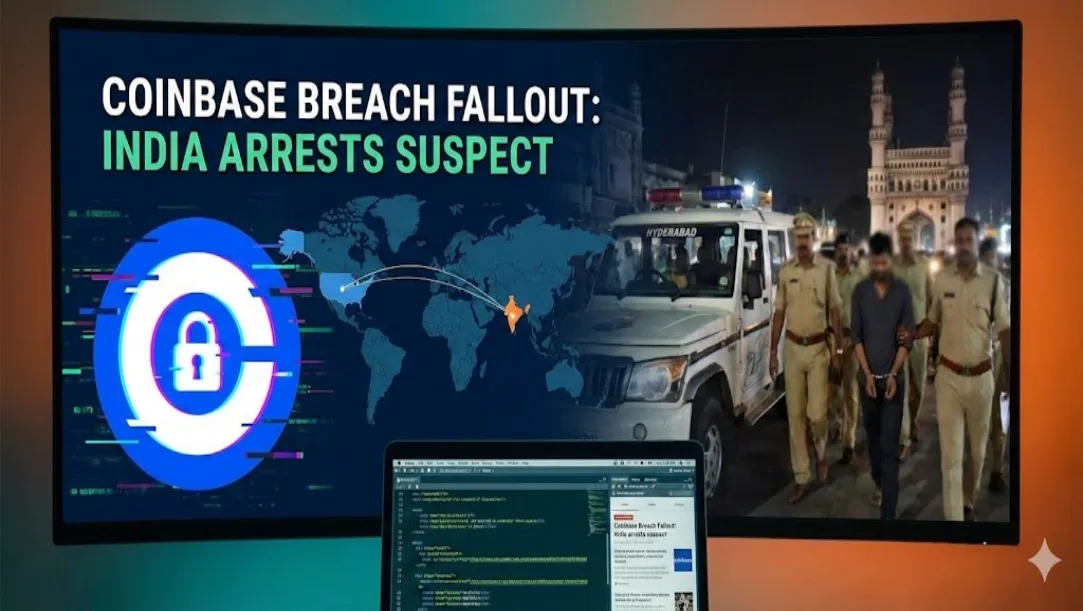

On December 27, 2025, the international cryptocurrency community witnessed a major breakthrough as authorities in India arrested a former customer support agent linked to the massive Coinbase breach fallout. This high-profile arrest in Hyderabad follows a months-long investigation into a sophisticated insider attack that compromised the personal data of nearly 70,000 users. While the initial security incident occurred in May 2025, the legal consequences are now rippling across the globe, signaling a zero-tolerance policy for digital asset crimes.

The breach began when a group of overseas hackers allegedly bribed third-party contractors to gain unauthorized access to internal tools. Consequently, these bad actors were able to exfiltrate sensitive details, including names, phone numbers, and account balances. Shortly after the intrusion, the hackers attempted to extort the San Francisco-based exchange for a staggering $20 million ransom. However, Coinbase refused the demand and instead established a $20 million bounty fund to track down the perpetrators, a move that eventually led investigators to the doorstep of the rogue agent in India.

The Global Impact of the Coinbase Breach Fallout

The financial scale of this security failure is unprecedented for a major U.S. exchange. Internal projections suggest that the total Coinbase breach fallout could cost the company between $180 million and $400 million in remediation and legal expenses. Furthermore, the compromised data fueled a secondary wave of social engineering attacks, where scammers impersonated official representatives to drain individual wallets. Reports indicate that at least one victim lost over $2 million in a single transaction due to these highly convincing impersonation schemes.

Despite the severity of the incident, Coinbase CEO Brian Armstrong remains defiant against cybercriminals. “Thanks to the Hyderabad Police in India, an ex-Coinbase customer service agent was just arrested. One down and more still to come,” Armstrong stated in a public announcement on Friday. This sentiment underscores a growing trend of cooperation between private tech giants and international law enforcement agencies to secure the decentralized finance landscape.

Strengthening Security After the Coinbase Breach Fallout

In response to the crisis, the exchange has significantly overhauled its internal controls. By phasing out certain third-party support contracts and implementing stricter “zero-trust” architecture, the company hopes to prevent future insider threats. Additionally, the IRS and the SEC have launched inquiries into how contractors were able to access sensitive PII (Personally Identifiable Information) so easily. According to The Economic Times, the arrest is part of a broader crackdown involving U.S. prosecutors who recently charged a Brooklyn man for running a related impersonation scheme targeting the same user base.

Security experts recommend enabling hardware-based two-factor authentication and staying cautious of unsolicited calls or messages from anyone claiming to be from a support team. While the arrest in India marks a significant victory for the industry, the ongoing legal battles and regulatory scrutiny suggest that the shadow of the May breach will loom over the crypto market for years to come.