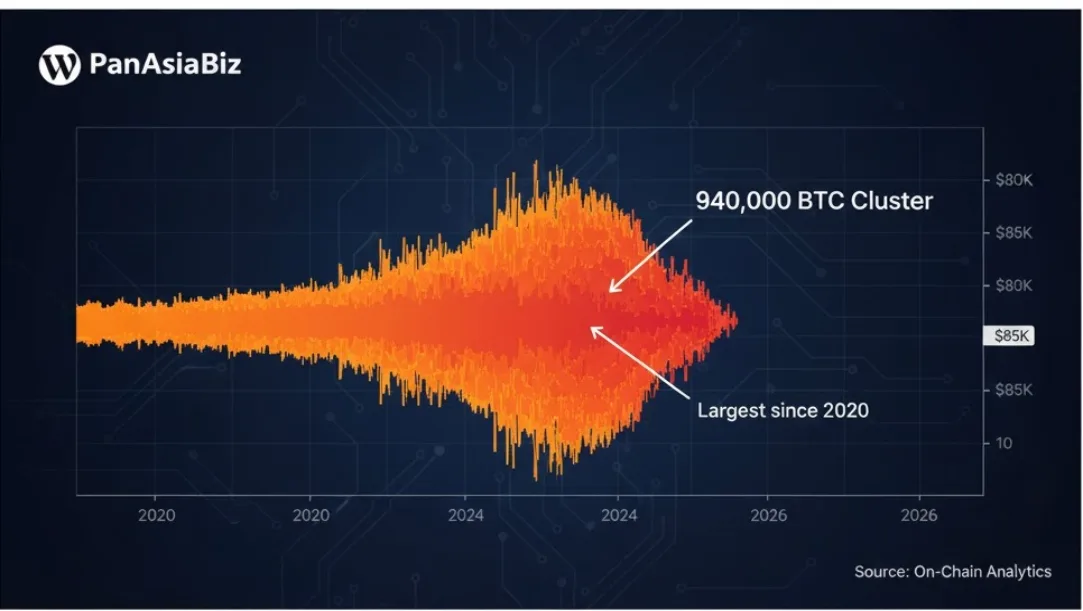

As of January 1, 2026, the crypto market is reacting to a historic development on the blockchain: a massive Bitcoin supply cluster has formed in the $84,000 to $85,000 price range. On-chain data reveals that approximately 940,000 BTC moved within this narrow window, creating the densest cost-basis concentration seen in years. Analysts from multiple financial firms note that this is the largest accumulation zone since the 2020 bull run, suggesting that investors are establishing a “new floor” for the digital asset.

Analyzing the $84K–$85K Bitcoin Supply Cluster

The formation of this Bitcoin supply cluster indicates that nearly one million coins were purchased or transferred as Bitcoin consolidated near its latest all-time highs. This specific heatmap data is vital because it shows where the majority of “current holders” would break even. Transitioning into the first quarter of 2026, this $84K–$85K zone now acts as a formidable wall of support. If the price remains above this level, the market enters a period of high stability; however, a dip below could trigger a rush to exit positions.

Statistics show that this cluster represents nearly 5% of the total circulating Bitcoin supply. This level of concentration is rare and typically happens only during periods of extreme institutional accumulation. Furthermore, compared to previous cycles, the current distribution is much tighter, meaning market participants are more aligned on the asset’s current value than they were during the volatile swings of 2024 and 2025.

Market Implications for the 2026 Bull Cycle

Why does this Bitcoin supply cluster matter for the average trader? When such a large volume of coins is held at a specific price, it creates a psychological anchor for the market. According to CoinGlass News, these “liquidity clusters” often dictate where the next major price breakout will occur. As one senior analyst remarked, “We are seeing the strongest foundation in Bitcoin’s history; the $85,000 mark is no longer just a number, it’s a fortress.”

Moreover, the absence of similar clusters above $90,000 suggests that if Bitcoin breaks its current resistance, there is very little “overhead supply” to slow it down. Therefore, the current Bitcoin supply cluster serves as a launching pad for potential six-figure valuations later this year. In conclusion, the 940,000 BTC sitting at this level confirms that institutional conviction is at an all-time high, marking a significant milestone in the 2026 financial calendar.