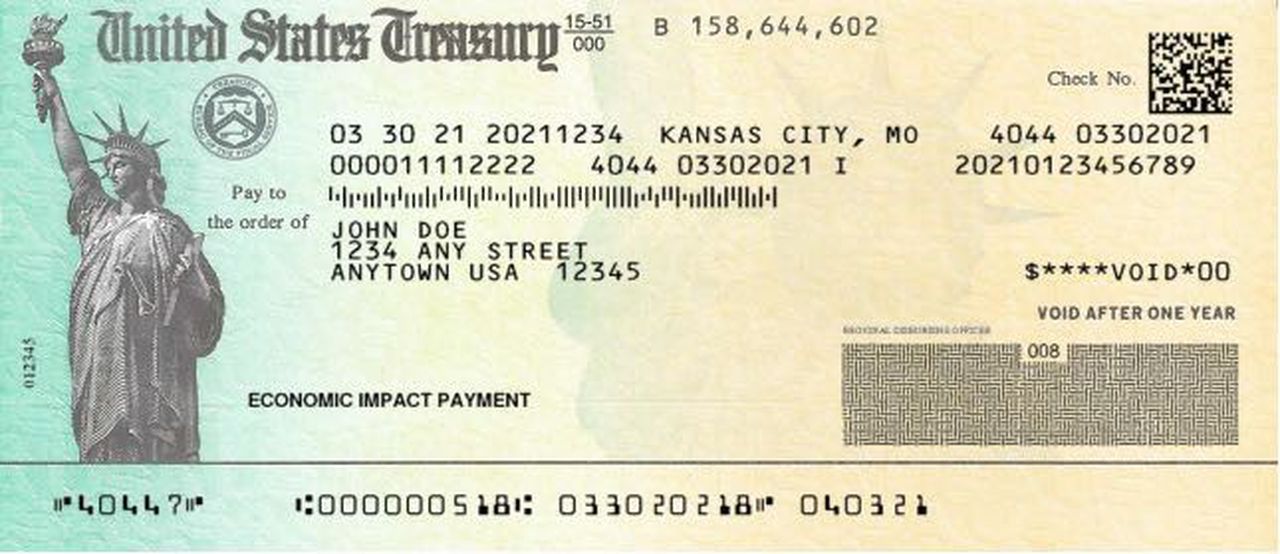

Millions of Americans are enjoying the extra credit benefit in the form of stimulus checks issued by the “American Rescue Act”. Through this, Joe Biden’s government has made a point to lower the impact of the pandemic for the Americans.

The end of monthly child tax credit had created worry for the parents, but it was ruled out in the form of state-issued stimulus checks!

What is the child tax credit?

A child tax credit is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer’s income level.

Different programs of Stimulus checks in states

As the child tax credit is canceled by the federal government, the state government comes to the rescue.

States like California and Minnesota are the only two states offering programs like Golden State Stimulus II programs which offer California residents over $568 million in extra funding to make it through the end of the year.

A $285 check to over half a million residents is sent out to the qualifying residents of Maine.

Furthermore, in Maryland, qualifying individuals can receive anywhere from $300 to $500.

Professional-related checks worth $1000 are given out to first responders in Florida.

While, Seattle is offering payments to low-income individuals, like the Seattle Relief Fund which offers a one-time check up to $3000.

Columbia, Chicago, New Orleans, Pittsburgh, and Santa Ana are doing some Universal basic income for low-income individuals.

In Columbia, 100 low-income fathers will receive $500 monthly checks for a year.

Those making less than $35,000 in Chicago will be receiving $500 monthly payments, and Los Angeles has a similar program offering $1000 monthly payments to those making below the poverty line.

Teens in New Orleans will be getting $350 monthly payments through the state’s financial literacy program.

And Newark, New Jersey is expanding its “guaranteed income pilot program,” which allows 400 residents to get payments for two years.