Florida families and educators looking to relieve some of the financial burdens of the upcoming school year can take part in the annual back-to-school tax holiday, which started this week and will end on August 7.

The Florida Department of Revenue has released a Frequently Asked Questions document about the 2022 tax holiday, which outlines items exempt from sales taxes.

That includes the usual school supplies such as binders, calculators, notebooks, pencils, highlighters, scissors and paper, as long as each item is not more than $50.

Sales taxes also are exempt for certain pants, sweaters, shoes and other items and accessories for $100 or less per item, as well as jigsaw puzzles, flashcards and other toys used for reading or math skills with a sales price of $30 or less.

The big-ticket items, such as personal computers, are exempt from sales taxes based on a sales price of $1,500 or less.

Clothing items for certain extracurriculars such as dance and martial arts attire, choir clothing and scout uniforms are included in the tax holiday, according to the Florida Department of Revenue.

There are other ongoing tax holidays that may appeal to families and educators, including a year-long tax holiday on diaper purchases ending next June, and a tax exemption on children’s books ending on August 14.

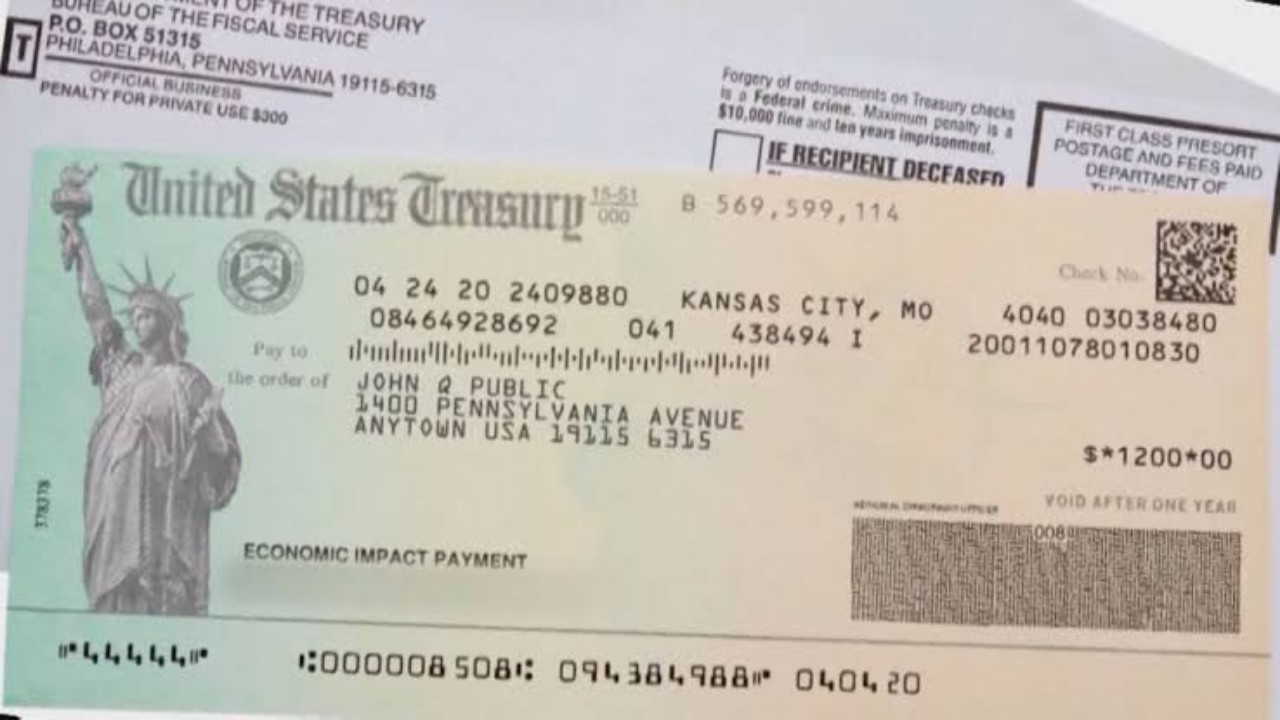

In addition, certain Florida families recently received a check for $450 dollars from the DeSantis administration.

The Florida Policy Institute, a non-partisan and non-profit organization, said in a written statement Tuesday about the stimulus checks:

“We thank Gov. DeSantis for using federal American Rescue Plan Act dollars to help families in Florida struggling to make ends meet. The $450-per-child checks will go a long way in covering back-to-school expenses and are especially helpful to households that rely on Temporary Assistance for Needy Families (TANF) benefits, which state lawmakers have not increased in 30 years.

“Without these checks, many TANF families would find it difficult, if not impossible, to buy necessities for school.”

Florida families and educators looking to relieve some of the financial burdens of the upcoming school year can take part in the annual back-to-school tax holiday, which started this week and will end on August 7.

The Florida Department of Revenue has released a Frequently Asked Questions document about the 2022 tax holiday, which outlines items exempt from sales taxes.

That includes the usual school supplies such as binders, calculators, notebooks, pencils, highlighters, scissors and paper, as long as each item is not more than $50.

Sales taxes also are exempt for certain pants, sweaters, shoes and other items and accessories for $100 or less per item, as well as jigsaw puzzles, flashcards and other toys used for reading or math skills with a sales price of $30 or less.

The big-ticket items, such as personal computers, are exempt from sales taxes based on a sales price of $1,500 or less.

Clothing items for certain extracurriculars such as dance and martial arts attire, choir clothing and scout uniforms are included in the tax holiday, according to the Florida Department of Revenue.

There are other ongoing tax holidays that may appeal to families and educators, including a year-long tax holiday on diaper purchases ending next June, and a tax exemption on children’s books ending on August 14.

In addition, certain Florida families recently received a check for $450 dollars from the DeSantis administration.

The Florida Policy Institute, a non-partisan and non-profit organization, said in a written statement Tuesday about the stimulus checks:

“We thank Gov. DeSantis for using federal American Rescue Plan Act dollars to help families in Florida struggling to make ends meet. The $450-per-child checks will go a long way in covering back-to-school expenses and are especially helpful to households that rely on Temporary Assistance for Needy Families (TANF) benefits, which state lawmakers have not increased in 30 years.

“Without these checks, many TANF families would find it difficult, if not impossible, to buy necessities for school.”

Florida Phoenix is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Florida Phoenix maintains editorial independence. Contact Editor Diane Rado for questions: info@floridaphoenix.com. Follow Florida Phoenix on Facebook and Twitter.

Our stories may be republished online or in print under Creative Commons license CC BY-NC-ND 4.0. We ask that you edit only for style or to shorten, provide proper attribution and link to our web site. Please see our republishing guidelines for use of photos and graphics.

Danielle J. Brown is a 2018 graduate of Florida State University, majoring in English with a focus in editing, writing, and media. While at FSU, she served as an editorial intern for International Program’s annual magazine, Nomadic Noles. Last fall, she fulfilled another editorial internship with Rowland Publishing, where she wrote for the Tallahassee Magazine, Emerald Coast Magazine, and 850 Business Magazine. She was born and raised in Tallahassee and reviews community theater productions for the Tallahassee Democrat. She spends her downtime traveling to all corners of Florida and beyond to practice lindy hop.