[ad_1]

- Chainlink has been noting continuous accumulation since the beginning of September following a massive sell-off days before.

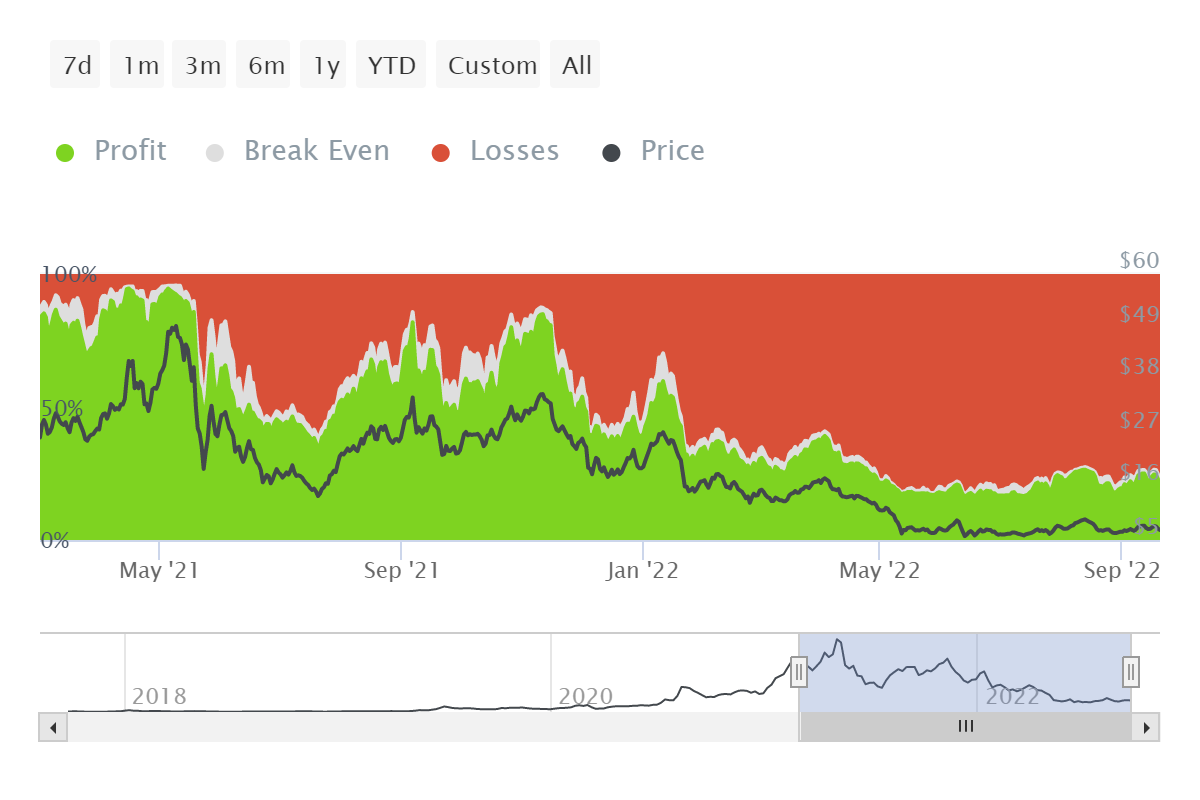

- The price decline has leftover 75% of all Chainlink investors in losses.

- Despite repeated lower lows formation, LINK is naturally maintaining a consistent uptrend which began in June.

Chainlink, impacted by the broader market trend, noted repeated fluctuations in price over the last four months. However, standing apart from other cryptocurrencies, LINK is at least a little above its lows of June and July. This is possible thanks to its holders, who have been maintaining a bullish stance towards the crypto.

Chainlink poised for a comeback

Since the beginning of the year, there have been all but only two instances of unprecedented and immediate sharp selling, and both of these took place during moments of unforeseen crashes.

The first one took place back in June when the entire market crashed and LINK holders sold over 10 million LINK tokens in a week. The second and most recent instance occurred towards the end of August when in a single day, about 17 million LINK worth $117 million were sold by investors.

[08.44.23, 21 Sep, 2022]-637993284555836838.png) Depleting supply of Chainlink in exchanges

Depleting supply of Chainlink in exchanges

Following the crash, the price recovery has been slow and, at many times, disappointing, but the gradual accumulation has led to the investors reclaiming about 13.5 million LINK tokens worth about $93.15 million.

Interestingly accumulation isn’t the only constant occurrence, as, despite the consistent formation of lower lows, LINK is maintaining its broader market uptrend.

As visible on the chart, after creating a local top last month, LINK noted a 25.87% dip again. This brought the price from $9.3 to $6.9, which is still above the June lows of $5.9.

But the wait continues

Although LINK might appear to be in an uptrend, its effects are yet to be seen on its 686k investors as only 23% of investors still enjoying profits since May.

Chainlink investors in losses

This situation can only be turned around when LINK makes it to $20, which in the past has been the price point at which at least 50% of all investors were in profit.

[ad_2]