The pandemic’s inflation has forced Americans to make difficult financial decisions. Many states are providing different forms of financial support to lessen the suffering.

Ohio residents who meet the requirements still have the opportunity to apply for such a $500 energy aid program. However, Ohioans are not receiving additional funds in comparison to other places, such as California, where certain residents may begin receiving inflationary relief checks next month.

States Providing Residents With Additional Aid

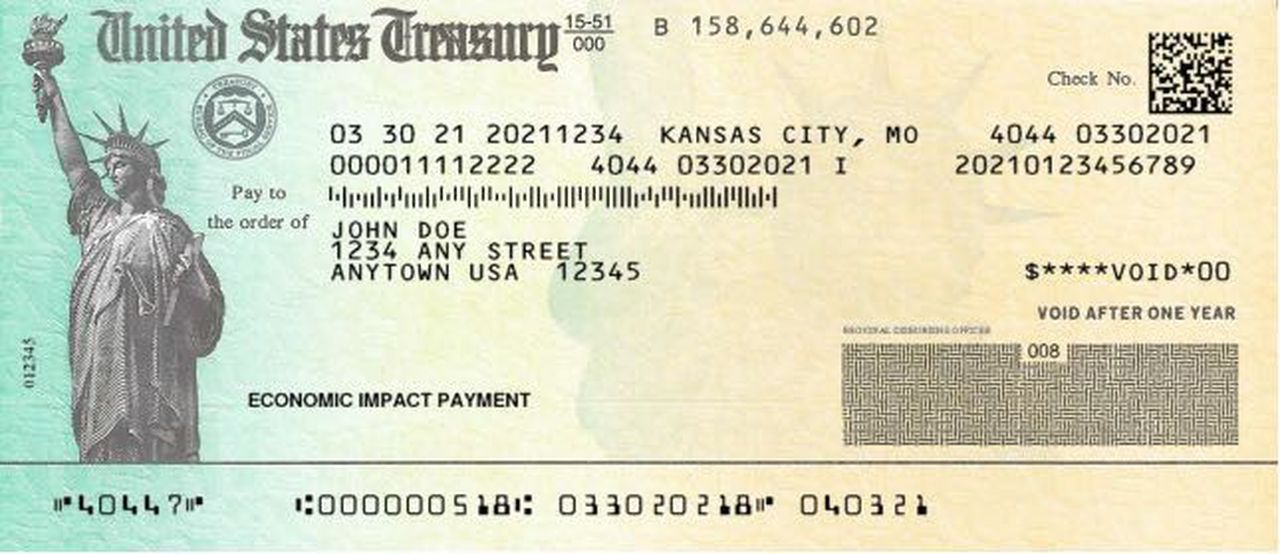

Californians are particularly impacted by rising costs because their state is one of the priciest in the nation. Beginning in October, millions of citizens will get inflation relief checks up to $1,050. No one who earns more than $250,000 is eligible.

New York made an effort to assist residents with their property taxes, just like New Jersey did. Beginning in June, the Homeowner Tax Rebate Credit distributed up to $1,050 to eligible households. Later this fall, residents of New York City will also be eligible for a unique property tax relief.

Some people who qualify for President Biden’s student loan forgiveness program can see up to $20,000 in debt forgiven while still making payments on their loans at 0% interest through December 31.

An inflation aid plan put out by Nan Whaley, the former mayor of Dayton and current opponent of Mike DeWine for governor, would provide $350 payments to many Ohioans.

Who Can Claim?

Residents with a tax burden who funded state income taxes are qualified to claim up to $250, or $500 for filing jointly, from the state. Who is eligible is specified in this entertaining film.

By the middle of October, taxpayers who submitted their taxes on the schedule should receive their money. Individuals who have disabilities, low-income renters, and senior homeowners who meet the requirements can get relief checks through the Property Tax/Rent Rebate Program, which people can apply for through December 31 reports Fox 8.