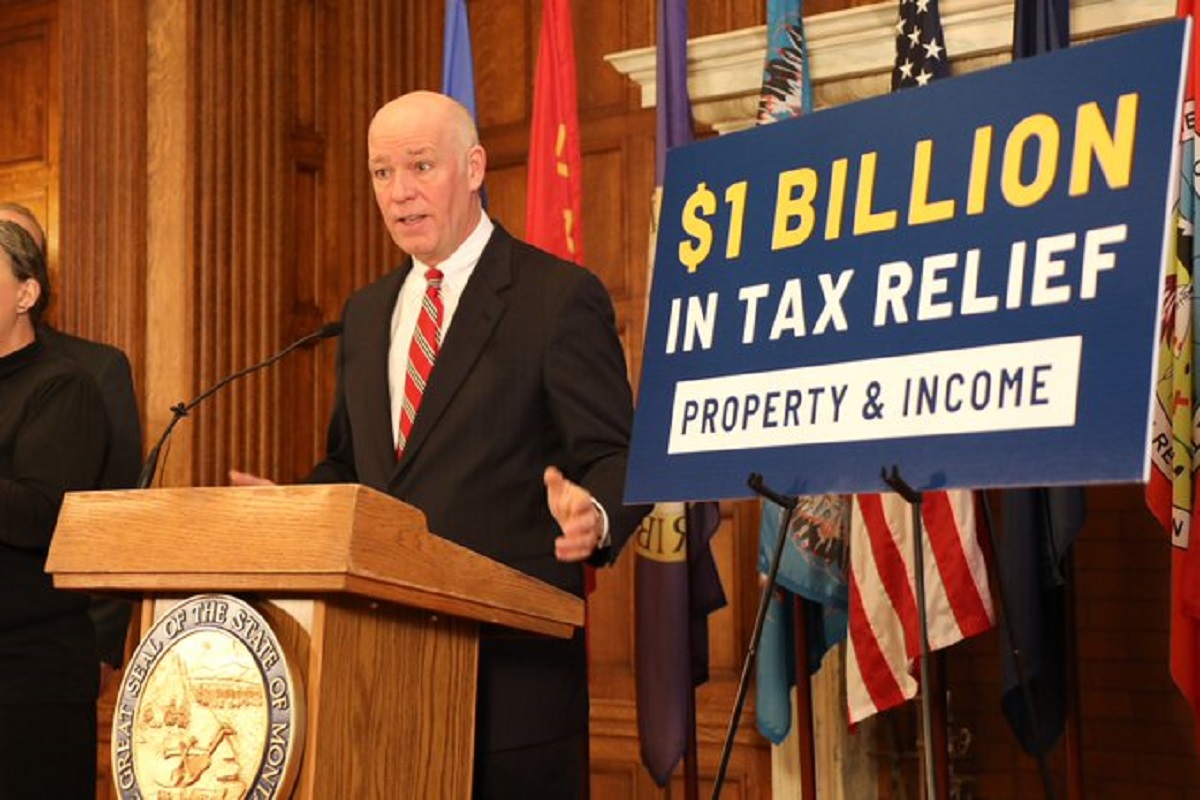

Montana Governor Greg Gianforte announced a plan to use the state’s $ 1 billion budget surplus to fund tax cuts and credits.

The Governor’s Budget for Montana Families would cut the top income tax rate from 6.5 percent to 5.9 percent, as well as introduce a $1200 tax credit for children under six and a $5,000 adoption credit.

The proposal also includes $500 million in property tax relief.

“I fundamentally believe hardworking Montanans should keep more of what they earn. And with inflation at a high not seen in 40 years, providing Montanans with tax relief is all the more important,” said Gianforte.

All of our tax proposals are rooted in a simple philosophy: hardworking Montanans should keep more of what they earn. We’re ready to give Montanans $1 billion in tax relief, and we look forward to working with the legislature to do it. pic.twitter.com/e0Uwcy71qp

— Governor Greg Gianforte (@GovGianforte) January 5, 2023

The proposal will be formally introduced to the Montana state legislature when it reconvenes in early January.