No More Denials On Direct Lender Installment Loans

Denials are what most people hate when acquiring a loan. This is also contributing to the reluctance of most people to apply for a loan. The reasons for the denial are extensive. It can be due to a poor credit history. They are not fulfilling the rules and policies of the lender etc.

Sometimes the terms posed by the lender or loan disbursing authority are not in borrower’s favor. This will prevent you from coping with your emergency or non-emergency financial needs. But what to do in such a situation? Don’t worry. We have got a solution for you which is a US installment loan.

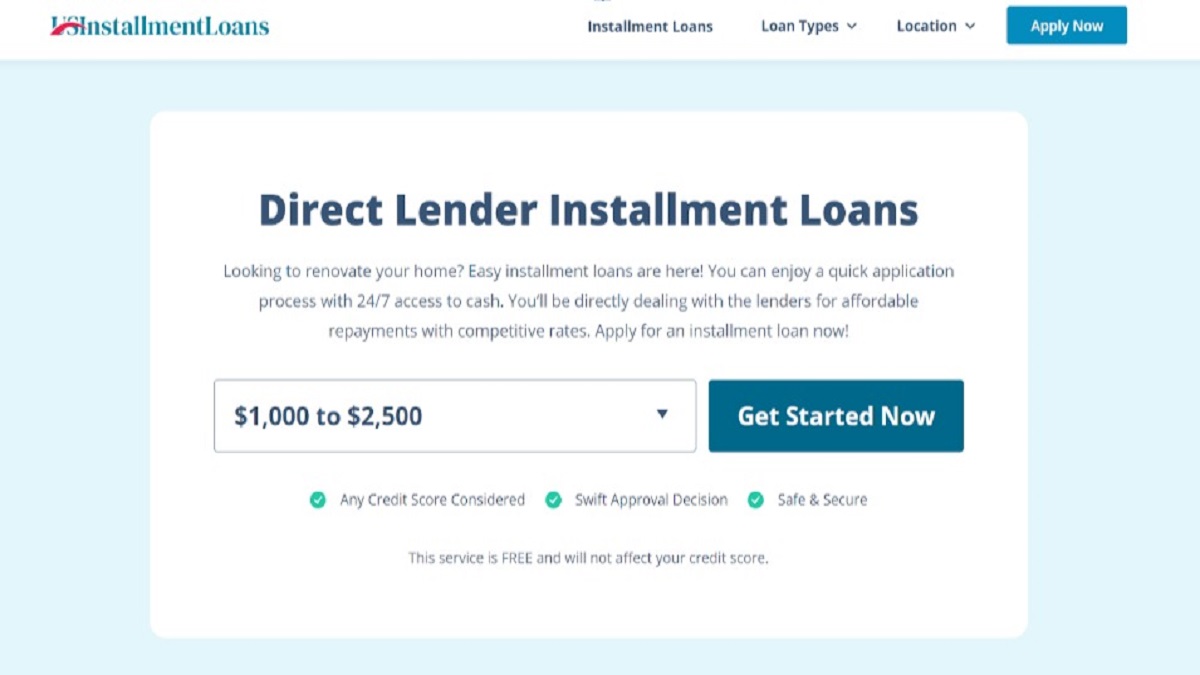

US installment loan offers guaranteed approval. There is no fear of being rejected. Anyone can apply for an installment loan from direct lenders. This article aims to curate sufficient, beneficial, and practical information on installment loans from direct lenders. Sounds good? Keep reading to uncover the facts!

What are Installment Loans From Direct Lenders?

Another name of an installment loan is also a personal loan. The term installment reflects that you will pay back this loan in installments. You can set up total installments based on the total funds plus the interest you acquire.

US installment allows you to set favorable terms solely focusing on your needs and requirements. The term installment loans from direct lenders also specify that you will get such loans from lenders directly. No middle person will take the benefit or pose extra fees in loan acquisition.

Installment loans also refer to small loans featuring low credit. The soft loan amount also eliminates further guarantee requirements or hard credit checks by direct lenders. When getting these loans, there is also security associated. Some loans do not require any deposit.

This means if you are an employee or have some property, this will act as a security to the direct lender. In such loans, the interest rate is comparatively lower. While on the other hand, unsecured installment loans do not require any security, but they also pose you to face higher interest rates. You can choose anyone based on your requirement or need.

Why Should You Apply From Direct Lenders?

This question comes to mind when applying for a loan. There are several reasons thatpel you to apply from direct lenders on this page. The most notable reasons are:

Quick Fund Transfer/ Approval

When you deal one to one with a lender. They are alone who are handling the entire process and no third person or party is involved. The approval process gets easier in this way. This means you eventually get a quick fund transfer. You don’t need to wait for entire weeks to get this done.

Security

You can trust that your information is completely safe. While in third-party involvement your information keeps on moving from one person to another. There is a chance that anyone can misuse it. Therefore when choosing the direct lender you and your information is in safe hands. This also limits identity theft.

Convenience

When dealing with direct lenders you don’t need to go to your lender each time to facilitate the loan acquisition process. Rather direct lenders exist online which means they are easy to retrieve. You can contact them anytime you want and get an update on the process. This eventually makes the process smoother. You can use any device such as a desktop, mobile, laptop, or even a tablet to access the lender.

What Are The Alternatives To USInstallmentLoans’ Installment Loans?

Multiple alternatives exist on the internet today in comparison to the USInstallment loans. We have compiled a list of these alternatives. Read more below to get awareness:

Payday Loan

A payday loan refers to a loan that you acquire for a very short duration. Say you acquire such type of loan just between the duration of two paychecks. As soon as you receive your paycheck you need to pay back the loan amount. The interest amount of payday loans is comparatively less than on other loans. Payday loans do not consider poor credit history or bad credit. You can get this loan even with zero credit in your account.

Title Loan

The title loan refers to the loan taken against an individual car. The term title in this section refers to the car title. You can also say your car works in terms of security to the lender. This loan also refers to a short-term loan. In case of not pay the loan on time your car is taken up by the lender. These loans are worth it for paying emergency finances. The interest amount also lies in between not very high and not very low.

Personal Loan

These loans refer to the loan which you acquire based on your personal needs to cope up your severe financial situation. You can use the money to settle your debt, bills, fees, etc. Personal loans are loans which do not require any collateral or security from your end. It also does not take into account what is your credit history, if it is good or bad. You are liable to set your loan based on the set time period and interest rate. This loan allows you to get any amount you want but at higher interest rates. In other words, the loan amount decides the interest rate.

Will installment loans from direct lenders affect my credit score?

If the installment loan is going to affect your credit score or not. It totally depends on the behavior you adopt with the terms and policies. If you set the loan amount prior to the set time then this will eventually not be going to affect your credit score. On the other hand, if you fail to do so, then surely it will affect your credit score.

In general, when you first get an installment loan it greatly affects your credit score. This thing direct lenders understand completely they can cope with you in this regard. But after some time they don’t do so. Not paying on time will also lead you to face a strict level of inquiry and even a higher load of loan debt.

One thing that matter is all the loan-offering agencies or financial institutions prepare a report on your credit history. They put this information into their credit score. This information is ultimately beneficial for the potential leader, as it helps them understand you.

With this information, the direct lender can also access, if you are able to set up the acquired loan or not. They utilize this in risk prediction. The only solution that can take you out of this scenario is making payment on time.

Conclusion

When acquiring the loan, considering the acquisition from the direct lenders does matter. This will eventually help you play safe, meet your goals faster, and avoid extra interests. We have shared everything with you in the above article regarding direct lenders.

Let us know what are your thoughts on the above article. Do you find it useful? If you have any questions let us know. We will not only help answer your questions but also eliminate any confusion. We would love to hear from you.