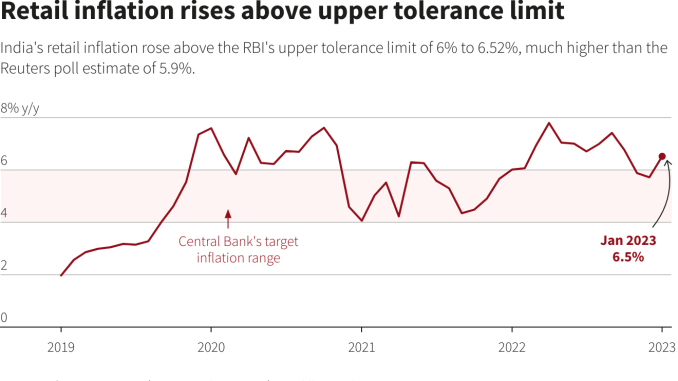

NSO released its data on inflation for the month Feb. It was amusing to see that RBI failed to eliminate the inflation problem after taking so many measures.

The current data shows that from Jan to Feb, the inflation rate decreased but very little and marginally, from 6.50% in January to 6.44% in February.

The national statistical office is a wing under the Ministry of Statistics and Programme Implementation; it is known for its survey and authentic data reports.

What is RBI’s plan?

To tackle the continuously escalating inflation rate, the RBI has taken some measures, including raising the Repo rate and following hawkish monetary policies. Still, it doesn’t seem to bring many differences.

The Impact of Measures

According to the current NSO data, the measures taken by the RBI are not creating an efficient impact, as inflation remains the central issue.

According to the RBI, 4% of the inflation rate is necessary for the nation’s development, and it should not exceed more than 6% and should not dip to less than 2%.

Currently, the inflation rate stands at 6.44%, which can potentially harm the country’s economic development.

Even after taking preventive measures, if the inflation rate remains the same, it is known as sticky inflation. And it can slow down the economic growth of any country.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1899048