Netflix reduced subscription prices in lots of regions, which is a good thing, right? Who could take issue with that – paying less for the same service. But investors don’t seem to appreciate this decision – Netflix stock went down after showing high figures for half a year. What will happen next? Let’s try to find out whether it is about time to buy the company’s shares or not.

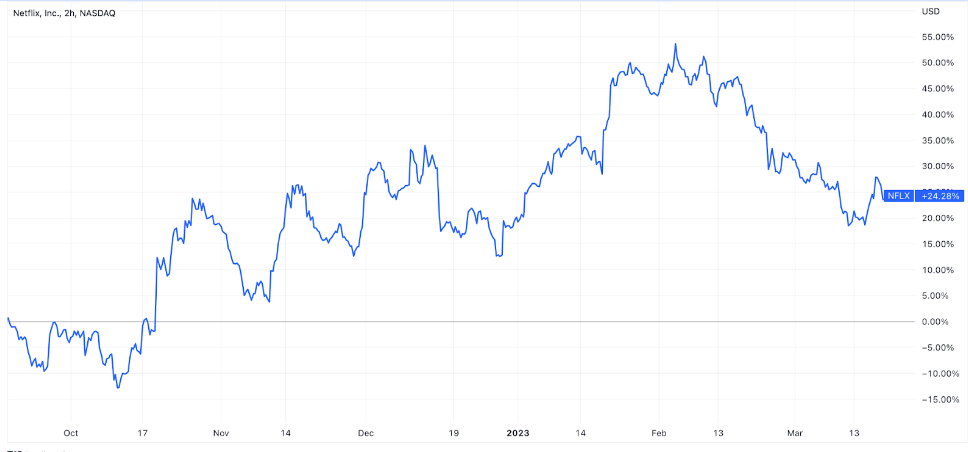

Netflix stock has grown by 24% over the last 6 months – and it was even near 50% at its peak moments after its impressive financial report on Q4 2022 results. You can see the progress on the chart below. However, it’s not just company releases that can affect the stock price. They’re also influenced by various world events, for example – policies of the Fed and other central banks. If you don’t want to miss these events, you can use economic calendar – it will alert you of all the major economic events.

But since the beginning of February, the trend has changed. Most likely it was caused by the news of Netflix restricting password sharing and cutting subscription prices in over 30 countries. The streaming company made these decisions in response to a drop in the number of users, increasing competition in the industry, and the economic crisis the world finds itself in.

Right now investors and Netflix users are not enthusiastic about these decisions, and this has influenced the share price. But everything may change when we take a long-term outlook. The streaming service might be able to attract a new audience and increase revenue from users – who are now less able to share logins and could be tempted by more attractive prices.

Also, Netflix is still the same legendary brand that knows how to generate viral content and create big hits. The latter of those however might be actually working against it. Some analysts think that in current conditions, it’s pretty difficult to act as a streaming service, and have that as the company’s only source of revenue. The competition is rising and there are now more diversified businesses participating in the race – such as Apple, Google, and Disney.

But the consensus forecast tells us that most analysts still believe in Netflix. The stocks may rise by 19% in the next 12 months.

One should remember that before buying or selling these shares or any other, it is necessary to do your own research. That’s the only way to become a successful investor.