Health insurance coverage enables you to receive top medical treatment without jeopardising your cash and savings. The Ayushman Bharat Yojana, in general, was enacted to ensure that everyone, even the most disadvantaged, can take advantage of the health card and accesses inexpensive healthcare and treatment.

What is Ayushman Bharat Yojana?

Each qualified Indian household receives ₹5 lakhs in health insurance coverage thanks to Ayushman Bharat Yojana, the world’s most extensive health insurance plan. Nearly half a billion individuals, or 40 percent of India’s poor and vulnerable households, will have access to secondary and tertiary hospital care under the Ayushman Bharat health card benefits. The program’s inception was motivated by a desire to reduce the crippling impact of medical bills, which each year drive almost a crore of Indians into poverty.

Key Features of the Ayushman Bharat Health Card

Let’s look at the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana’s (PMJAY) positive effects on the lives of its recipients and the health of the Indian healthcare system.

Mentioned below are a few features and inclusions of the Ayushman health card.

- This health insurance welfare programme provides coverage for intense and routine medical treatment and a family floater policy with a maximum benefit of ₹5 lakhs per family.

- Medical care at public health facilities and some private facilities that the government has approved is provided at no cost to the recipients and without the need for paperwork or out-of-pocket payments. In particular, the plan would prioritise providing health care for women, girls, and the elderly.

- The PMJAY will pay for advanced medical care in hospitals classified as “secondary” or “tertiary.” Daycare services, surgical procedures, pharmaceuticals, diagnostic testing, travel costs, cafeteria meals, and lodging are all paid for under this health insurance plan.

- Starting on day one, no hospital can refuse coverage or treatment for pre-existing conditions under the PMJAY health insurance scheme. Additionally, hospitals cannot demand any payment from PMJAY patients.

Ayushman Card Benefits

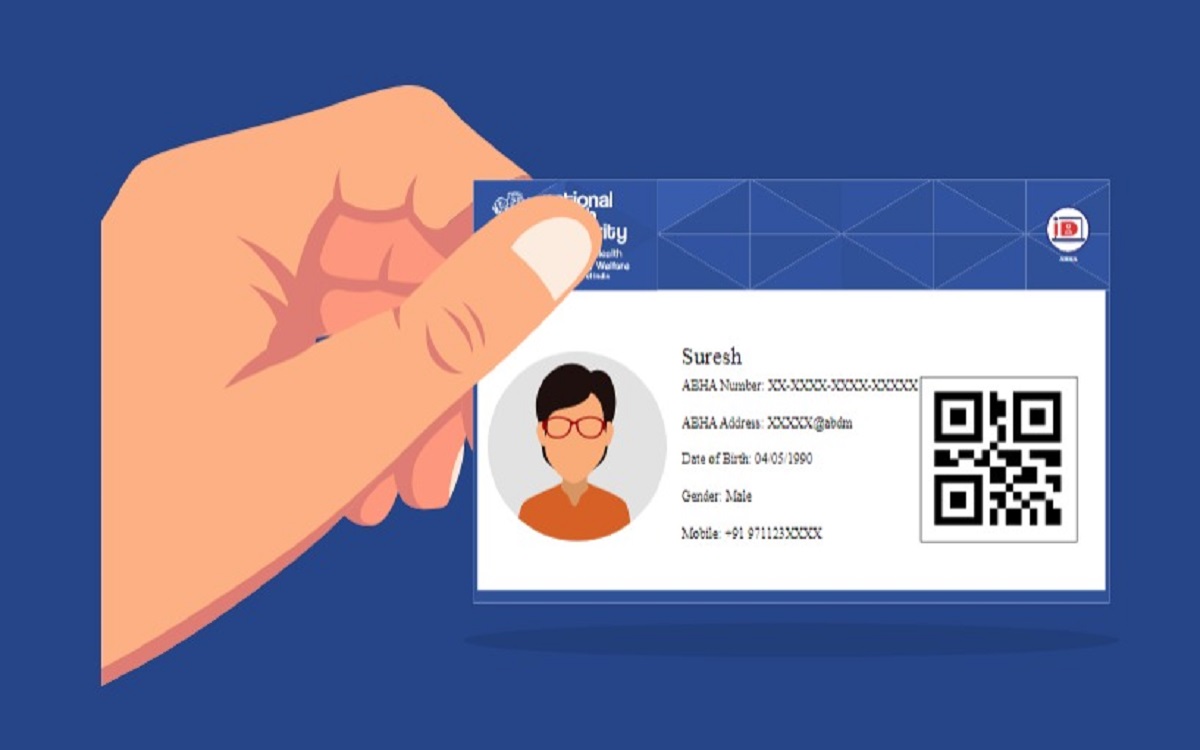

Stated below are the benefits of health card allowed under the Ayushman Bharat Health Account ( ABHA).

Automated and Digital Health Records

A patient has access to their health records from the time of admission through treatment and release. All of this information is readily available.

Easy Sign-Up

People can establish an ABHA health card using their cellphone number or Aadhaar card to access and share their digital health information. This easy mobile friendly approach benefits the elderly and helps in saving time.

Opt-In and Opt-Out Options

It is optional to obtain a National Digital Health ID card. One can obtain an ABHA number at their discretion. Similarly to enrollment, a person may opt-out of the ABHA programme at any time and request that their data be deleted.

Individual Health Records

An individual’s health records can be linked to ABHA. It assists a person in compiling a comprehensive health history.

Access to Physicians

The ABHA number (health ID) and Ayushman card benefits have access to approved physicians nationwide and eases the process of connecting with a doctor in time of need.

Private and Safe

The online creation of an ABHA (Health ID) is safe and secure. It is constructed with additional security features. Aside from this, the information is never shared without authorisation. And before enrollment, one can get an insight into what is a health card and its benefits to make a well-evaluated decision before registering for this health insurance coverage plan.

Conclusion

Concludingly, Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PMJAY) is a medical insurance programme run by the Indian government for the poor, the marginalised, and the most vulnerable members of society. Its goal is to make secondary and tertiary healthcare free of charge for people with low incomes.

PMJAY has no limits on the age, size, or number of people who can be insured. The benefits of this scheme are worth up to ₹5 lakhs and can be used by the whole family. In addition, eligible households can be covered by a single plan and get cashless hospitalisation coverage up to the coverage amount.