The Reserve Bank of India board authorized the transfer of Rs 87,416 crore to the Indian Government as a dividend for FY23 on Friday, May 19.

RBI’s surplus profit of ₹87,416 crore: What it means for government

The transfer of Rs 87,416 crore to the Union Government as a surplus or dividend for the accounting year 2022–23, approved by the Reserve Bank of India’s Central Board on Friday, significantly improved the Government’s financial situation.

#NewsAlert 🚨 RBI’s board approves transfer of Rs 87,416 crore as dividend to government for FY23#RBI #Budget pic.twitter.com/8qyVmlvZcY

— Moneycontrol (@moneycontrolcom) May 19, 2023

This is an increase of 188% from the excess transfer made the previous year (2021–2022), which was also the lowest in ten years and totaled Rs 30,307 crore.

A dividend of 480 billion rupees from the central bank, state-run banks, and other financial institutions is budgeted by the Government for the fiscal year 2023.

The dividend from public sector firms and other investments was raised to Rs 43,000 crore from Rs 40,000 crore in the Revised Estimate for FY23.

Compared to the RE of Rs. 1,08,592 crore for the financial year 2022–2023, the total dividend collection for the next fiscal year would be Rs. 1,15,820 crore.

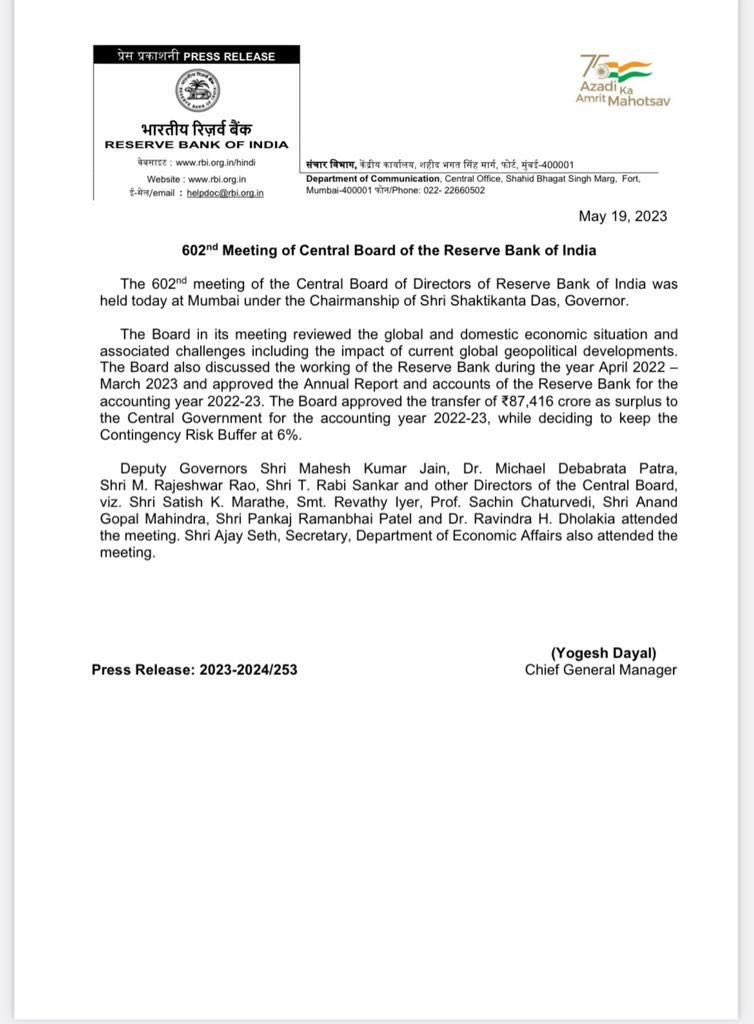

The choice was made at the Reserve Bank of India’s Central Board of Directors in the 602nd meeting, which was presided over by Governor Shaktikanta Das.

Other Issues Discussed

The impact of recent global geopolitical developments was also discussed by the board, along with the state of the economy both domestically and globally.

The board even addressed how the RBI will operate in 2022–2023 and approved the central bank’s annual report and financial statements.

As per the Mint reports, the RBI board also decided to increase the Contingency Risk Buffer from 5.50% to 6%.

The administration of Prime Minister Narendra Modi hopes to reduce the budget deficit from 6.4% of GDP in the previous fiscal year to 5.9% of GDP in the current fiscal year by increasing dividend payouts.