Advanced Micro Devices, Inc. (NASDAQ:AMD) is an American company engaged in producing and selling CPUs, graphics processors, and other computer components. Established in 1969, AMD has become one of the major players in the computer technology market.

The company has gained recognition for its innovative technologies, including multicore processors and graphics accelerators. AMD places great emphasis on developing new technologies to enhance computer performance and accelerate applications. In addition to manufacturing computer components, Advanced Micro Devices, Inc. develops software for its products, including the Linux operating system, used on computers and servers globally.

AMD has been actively expanding its business in Asia, rendering services to various industries such as gaming, scientific computing, and graphic design. Furthermore, AMD is focused on extending its global presence, maintaining offices in over 70 countries.

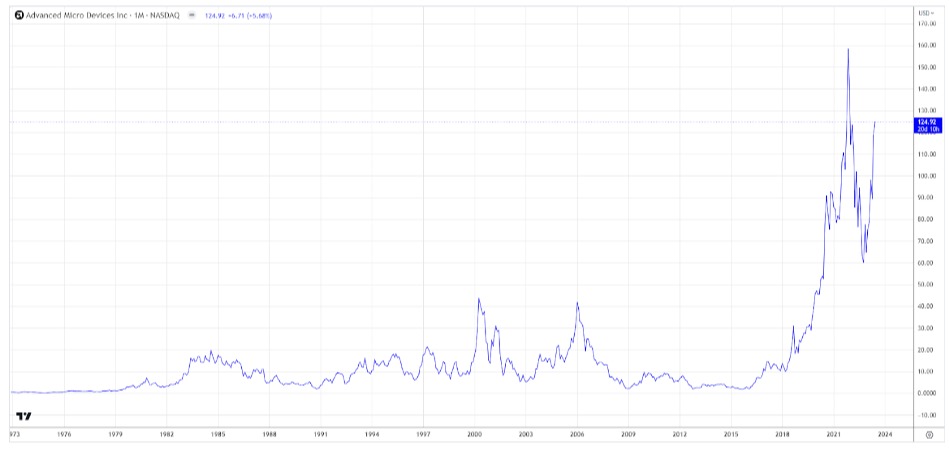

Interestingly, despite the intense competitiveness in the microprocessor market, the company remains afloat thanks to its CEO, Lisa Su. She managed to carry out one of the most ambitious transformations in the history of Silicon Valley, increasing the bankrupt semiconductor manufacturer’s stock value nearly thirtyfold in less than a decade.

According to the latest news, AMD aims to keep pace with Intel (NASDAQ:INTC) in the field of artificial intelligence. AMD showcased its own demonstration at Computex in response to Intel’s unveiling of Stable Diffusion on its new Meteor Lake processor.

However, this is the first time we have seen the work of the new Phoenix AI core, XDNA AI. The primary concept behind the XDNA AI engine is to accelerate AI tasks, such as audio, video, and image processing, more efficiently and rapidly than the CPU or GPU. Oddly enough, AMD doesn’t seem to have any concrete plans to introduce the XDNA engine into its desktop processors. At the moment, it is exclusive for laptops and portable devices.

See Also- Enhancing Your Portfolio with a Stock Screener

Now, shifting to the downside, there have been reports of a power cable issue with the new AMD Radeon RX 7600 graphics card. The problem lies in the inability to fully insert the required 8-pin power connector.

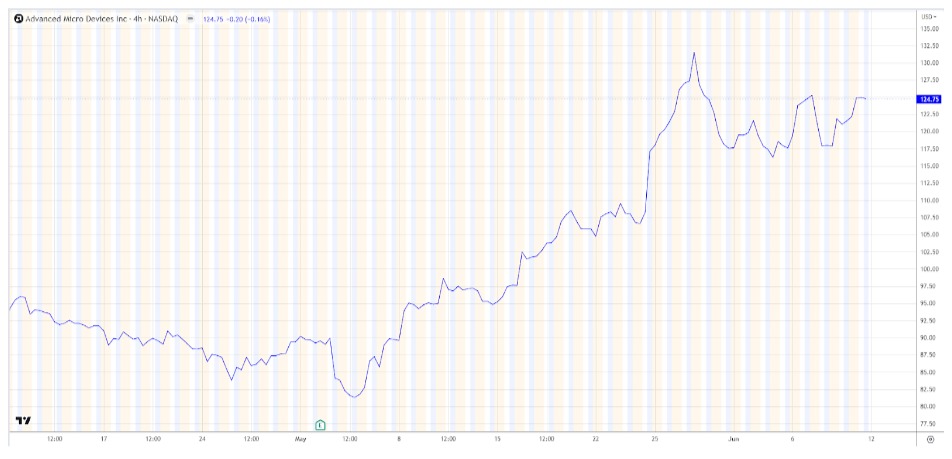

This issue has not affected the company’s stock prices. Since the last earnings report on May 2, 2023, the share value has increased by 50%. From a technical point of view, the current sideways movement may persist without significant news. And a rollback to $110 or even to $100 within a short recession is quite plausible. In any case, the economic calendar will provide guidance on when to take action.

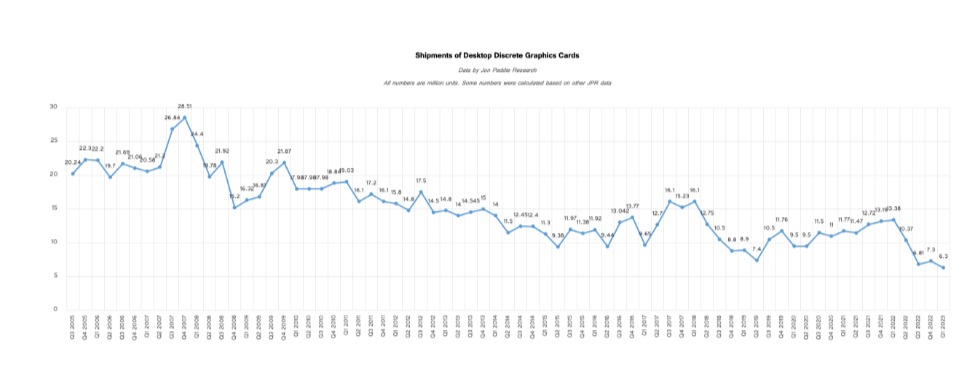

Why is it so safe to talk about a potential decline? According to the analytical company Jon Peddie Research, the desktop video card market is experiencing a continued downturn. In the first quarter of 2023, only 6.3 million graphics chips were sold, which is 12.6% less than in the previous quarter, and 38.2% less compared to the same period of 2022.

The gradual decline in video card sales observed by Jon Peddie Research is explained by the following reasons – people are spending less money on computer equipment due to inflation and fears of being laid off amid major corporate downsizing. As a result, people prefer to buy the previous generation used goods, taking advantage of significant discounts. This surplus of inventory has arisen after the end of the cryptocurrency boom.

Despite the decline in sales, there has been no significant shift in the market share distribution among the three main competitors in the discrete graphics card segment: AMD retains a 12% share, Intel’s share equals 4%, and NVIDIA occupies the dominant position with an 84% share (which seems to have a positive impact on NVDA stock).

Apparently, the technology market has a lot to offer. However, you should always your build your own research-informed view of things before upgrading your portfolio. This is rule #1 every investor should stick to.