Why is Bitcoin dominance important? The Bitcoin dominance index (BTC.D) is a ratio of Bitcoin (BTCUSD) capitalization to the overall capitalization of the cryptocurrency market. In other words, an upswing in Bitcoin dominance signifies an increased investment in Bitcoin compared to altcoins. This results in two potential outcomes: either BTC is growing faster than altcoins, or its decline is more gradual.

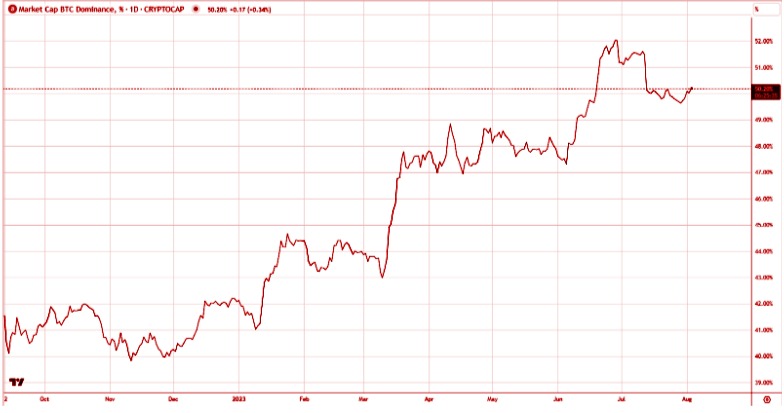

Since the beginning, Bitcoin has dominated the digital asset market. Currently, the dominance index has dropped to 50% and fluctuates within this range. However, on a global scale, Bitcoin dominance has recently burgeoned. This is due to the struggle of the American regulator against altcoins, which the SEC regards as attempts to circumvent coin issuance legislation.

But it is critical to remember that the Bitcoin dominance index does not directly reflect its value. That is, a lofty index does not necessarily mean that BTC is expensive. Instead, it acts more as an indicator of the market activity, helping to understand whether traders’ focus rests on the leading cryptocurrency or shifts towards altcoins.

However, the decline in metrics most often hinges on altcoins, not Bitcoin itself. This is quite logical, taking into account that new altcoins appear every day, enabling even modest investments to acquire millions of specific coins for potential gains. Granted, Bitcoin remains the premier investment and trading instrument, sustaining its popularity. Nevertheless, over the recent years, BTC has surrendered a substantial share of its market dominance.

The weight of BTC is huge, and a bitcoin rate forecast is often perceived as a prediction of the market’s overall sentiment. Investors can wield BTC dominance as a gauge when deciding to diversify their crypto portfolio.

The current growth of the BTC.D is attributed to several factors. First, Bitcoin is the most popular and well-known cryptocurrency, enticing continued investment. Secondly, Bitcoin is being used as a store of value and medium of exchange, which bolstered its market capitalization. Thirdly, numerous large companies are actively accepting Bitcoins as payment for their goods and services, augmenting its demand.

Also, the potential for continued growth looks quite promising since a call-to-put options ratio is exceeding zero, indicating the predominance of growth proponents. The recent introduction of derivatives at the end of June led to the Bitcoin’s growth by $7000, a commendable feat. At the moment, we can observe a minor correction and a pullback of the price.

Bitcoin dominance is also associated with its mining. With recent years having witnessed a surge in mining’s appeal due to its high profitability and low competition, there are more and more wallets containing freshly mined coins. The impact of such wallets is still difficult to track due to scant data. Nevertheless, it is safe to say that the volume of mining-generated coins continues to increase.

Although mining has become more complex, rendering the endeavor more intricate and costly, new mining facilities are cropping up worldwide. While the USA maintains its leading role, Russia and Asian countries are gaining prominence.

Despite the propagation of altcoins, the dominance indicator is poised for further growth. Bitcoin price remains relatively stable compared to multiple altcoins. Often, while the rest of the market loses 10% or more per session, Bitcoin’s decline is contained within 3% at best. As a result, the relative share of Bitcoins within the total crypto market cap enlarges.

Also, the relatively stable BTC rate offers investors a certain degree of protection, akin to gold in stock and currency markets. This leads to the outflow of substantial funds from the altcoin markets towards Bitcoin.

The clouds are gathering over altcoins, with the SEC increasingly engaged in crypto affairs. Unfortunately, the majority of these tokens serve (or have served) as conduits for money laundering, income obfuscation, and tax manipulation. And although they are in the shadow of Ripple (XPRUSD), facing likely perpetual litigation, officials continue to hunt for small altcoin-engaged companies.

The leaders of the total capitalization constantly fight for market share. The success of one project often entails a dent in other coins’ dominance due to the interception of their market share.

However, the Bitcoin dominance index also has its drawbacks. Firstly, a high concentration of Bitcoin’s assets renders it more vulnerable to market changes. Secondly, the growth of the dominance index may lead to diminished interest in other cryptocurrencies, potentially impeding their growth.

In general, the Bitcoin dominance index assumes paramount importance for investors and analysts aspiring to see Bitcoin’s effect on the crypto market. Nonetheless, this indicator should constitute merely one among numerous investment decision benchmarks.