The USD/RUB pair stands as one of the most significant currency duos globally, though it doesn’t rank as the most liquid. It reflects the ratio of the value of the US dollar to the Russian ruble and is of interest to both currency traders and investors. It also serves as a barometer for Russia’s economic health.

Formally, the pair emerged in 1992 after the collapse of the USSR and Russia’s shift toward a market-based economy. The US dollar has played a central role in international transactions for many years, with the ruble pegged to a dual currency basket. However, since 2014, the ruble has been gradually losing ground against the dollar, thanks to a medley of economic and political factors.

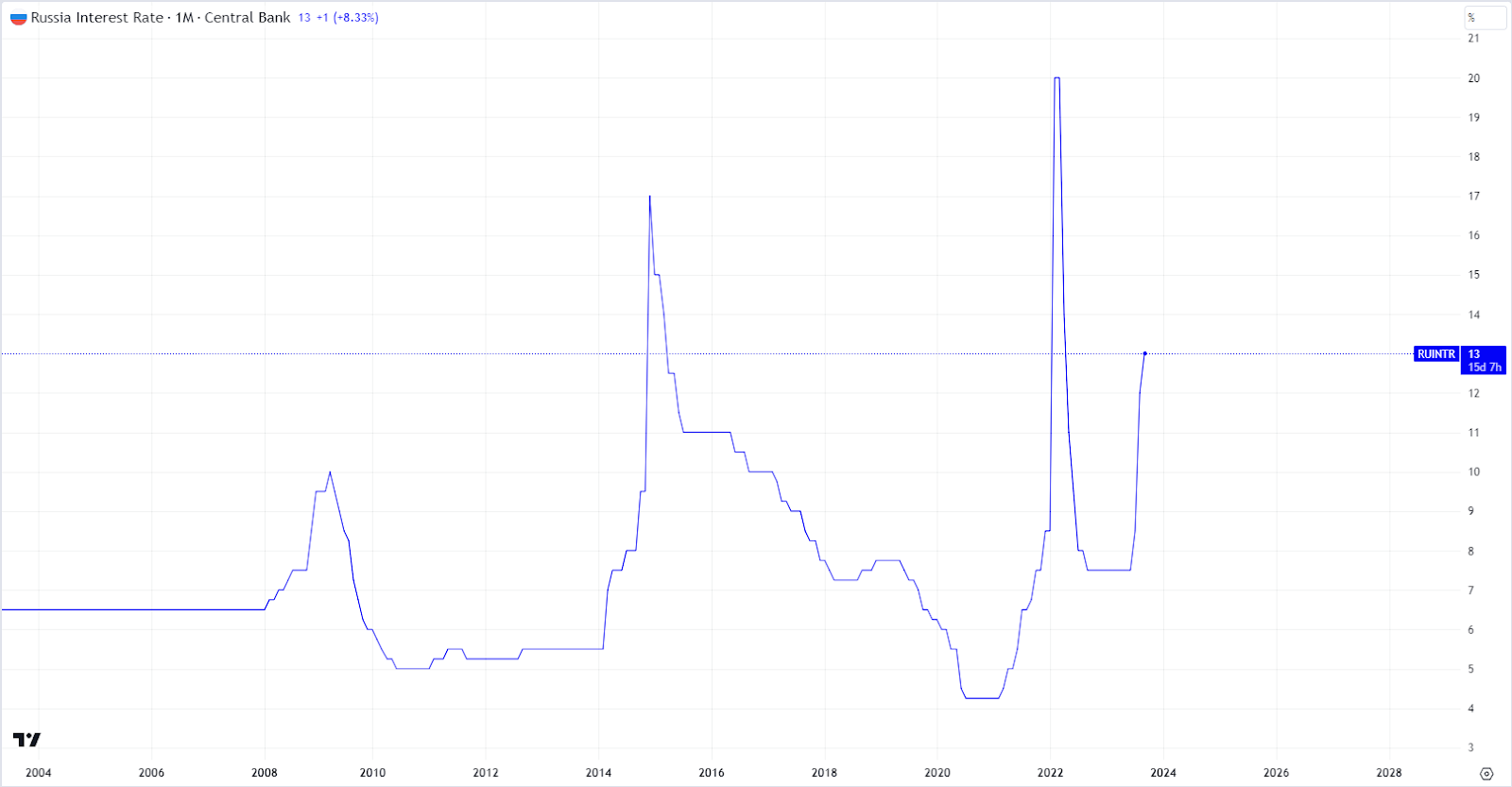

The dynamics of the USD/RUB currency pair is influenced by a variety of external and internal factors, including: shifts in the interest rates set by the US Federal Reserve System, economic growth and recession tends in the United States and worldwide, sanctions, the state of the Russian economy, and the monetary policy adopted by the Central Bank of Russia.

On September 15, a report of the Central Bank of Russia regarding a shift in the interest rates was released, as scheduled in the economic calendar. The current rate now stands at 13%, marking the fourth consecutive increase. This represents a 1% uptick compared to the previous month.

Given the relatively modest increase and the fact that the report was released on Friday, market activity remained subdued — there were no notable changes in the USD/RUB exchange rate, and the ruble didn’t experience any discernible consequences.

Taking a look at the chart, it’s evident that the price is trading within a horizontal corridor of 92.00-100.00. To put it simply, the upper boundary is defined by a resistance level, marked by the historical milestone of 100.00, often referred to as a psychological barrier. Meanwhile, the lower limit rests at a relatively new level of 92.00.

For now, it’s safe to assume that the ruble will continue to weaken in the coming years, especially given Russia’s current economic and political situation and the broader global arena. Nevertheless, the Russian economy holds potential for growth, which may contribute to the ruble’s strengthening in the long term, particularly in light of the development of the extractive and industrial sectors.