The SSE Composite Index (SSE:000001) stands as a crucial gauge of the Chinese economy’s state, illustrating the dynamics of the shares of the country’s largest corporations. The index was first introduced in 1990, and since then, it has served as a pivotal tool for analyzing the market and determining trends in China’s economic growth.

It plays a vital role in scrutinizing China’s economic state and determining trends in the development of the world economy. Investors closely monitor it when deciding on investments in the Chinese stock market. In addition, the SSE Composite Index is used to assess the effectiveness of China’s public policy measures in economics and finance.

The primary driver behind the index’s movements is the industry, particularly the production of chips and other microelectronics. Chip production stands out as a key factor determining the development of information technology and the electronics industry. China holds a prominent position globally in producing and advancing semiconductor components, establishing itself as a major player on the world stage.

China actively ventured into chip production following its accession to the World Trade Organization in 2001, gaining access to advanced technologies and commencing the production of its semiconductor products. By 2014, China had become the world’s third-largest chip manufacturer, trailing only the United States and Japan. Today, China leads in producing and exporting memory chips and semiconductor devices. This success can be attributed to government support, investment in research and development, and the application of advanced manufacturing technologies.

However, in October 2022, the United States imposed sanctions on some companies involved in microchip production, as well as on the import and use of related equipment. Despite the sanctions, China continues to procure equipment for advanced chip production. This persistence can be attributed to companies seizing an opportunity almost a year before Japan and the Netherlands joined the sanctions.

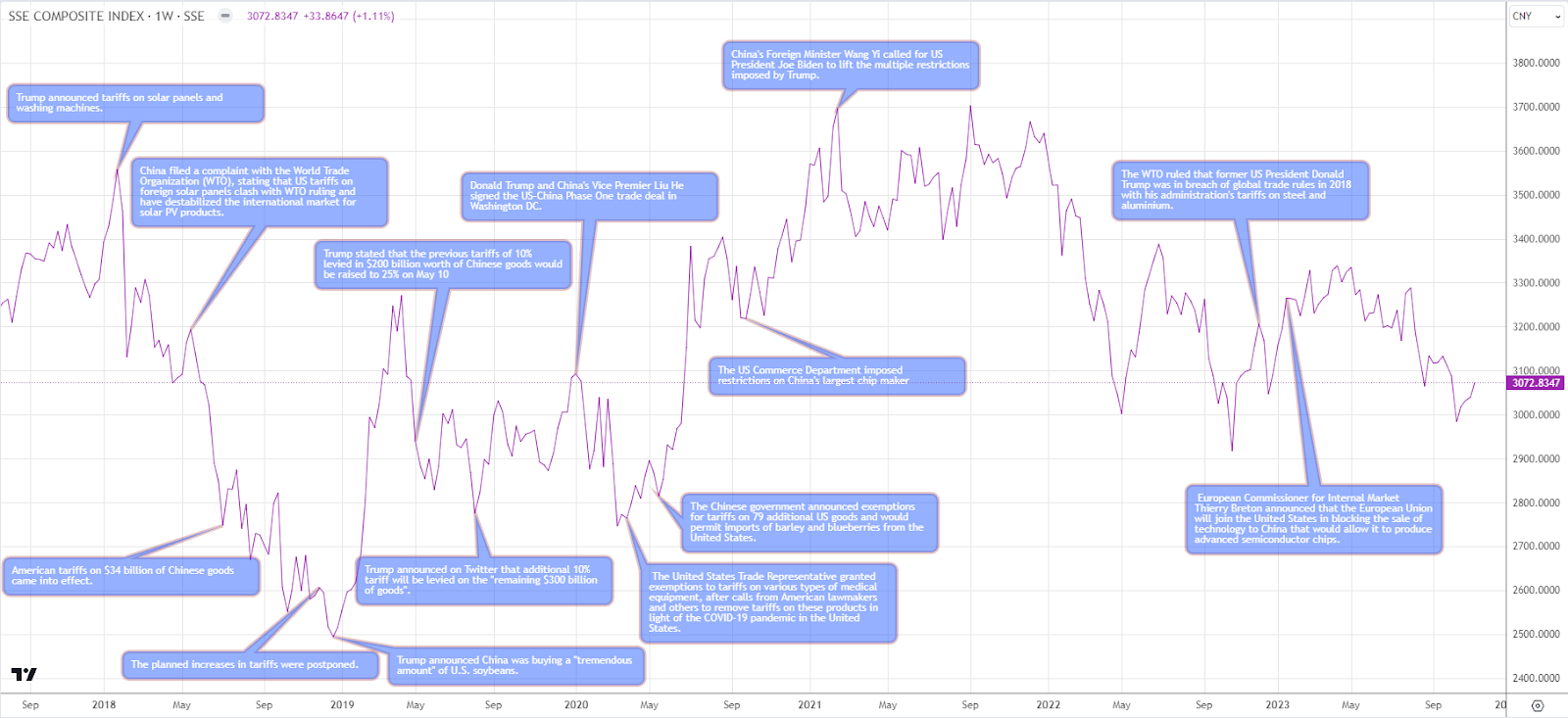

Examining the chronology of sanctions provides a global perspective on how index readings changed in response to the news, which can also be tracked in the economic data calendar.

But in fact, given the rapid growth of the Chinese economy and the increasing demand for semiconductor products, the outlook for chip production in the country appears highly optimistic. China aims to increase its share in the global chip market and diversify its product range.

To achieve these goals, the country is actively developing innovative technologies such as 5G, artificial intelligence, and high-speed Internet. Additionally, China engages in collaborative research and development with other countries, fostering the joint advancement of technologies.

In essence, chip production in China stands as a priority for developing the national economy and science. Successes in this realm have propelled the country into a leadership position in the global semiconductor industry, ensuring the stable development of the electronics industry overall.