In recent years, Intel Corporation (NASDAQ: INTC) has experienced losses and a notable revenue decline. In 2023, the company’s revenue decreased by more than 20%, reaching approximately $40 billion. The main reason for this decline was a decrease in demand for personal computers due to reduced stock levels.

The profitability of the peripheral equipment segment decreased from 22.2% to 17.8%, resulting in a 34.8% decrease in the segment’s operating profit, which fell to $3.6 billion. Revenue from the company’s second-largest segment, such as storage, data processing, and artificial intelligence, decreased by 22.5% to $11.5 billion. Operationally, the company recorded a loss of $608 million compared to a $1.9 billion profit gained a year earlier.

In the equally important network segment, the company also saw a 36% decrease in revenue due to reduced demand for Ethernet, Network, Xeon, and Edge products. Operationally, the segment recorded a loss of $470 million.

One factor contributing to the general decline is Intel’s absence among the leading artificial intelligence developers. The data center and AI solutions business saw a 10% revenue reduction to $4 billion. This is explained by the budget redistribution within the segment in favor of computing accelerators over central processors.

Despite the current AI boom, accelerators are more essential than processors. Thus, the server division’s revenue decreased by 20% to $15.5 billion for the entire year. Operating profit in the fourth quarter had to be reduced by 38% to $100 million. Competition pressure and surplus products in programmable solutions further hindered the company in the server segment.

The company reported a consolidated operating loss of $2.5 billion, compared to a profit of $3.5 billion a year earlier. Its net loss amounted to $980 million, compared to a profit of $8.7 billion the previous year. However, the company plans to counter this downturn through collaboration with United Microelectronics Corporation (NYSE: UMC).

Together, they aim to offer chip contract production services using 12-nanometer process technology. The collaboration extends to a semiconductor manufacturing platform targeting customers in mobile communications, communications infrastructure, and network technologies.

Intel’s large-scale production facilities in the USA and UMC’s expertise in contract manufacturing will facilitate the production of 12-nanometer products. Clients of the joint venture will benefit from diversified supply chains.

Intel’s production facilities and experience in developing FinFET-type transistor-based chips, combined with UMC’s customer experience, including Process Design Kit (PDK) preparation and assistance in mass production, will drive the project.

Intel’s financial situation remains challenging, and the company’s management is focused on performance improvement and business profitability. Investors have long awaited breakthroughs in AI from the company. While other organizations actively pursue AI integration and production setup, Intel noticeably lags or appears to lag.

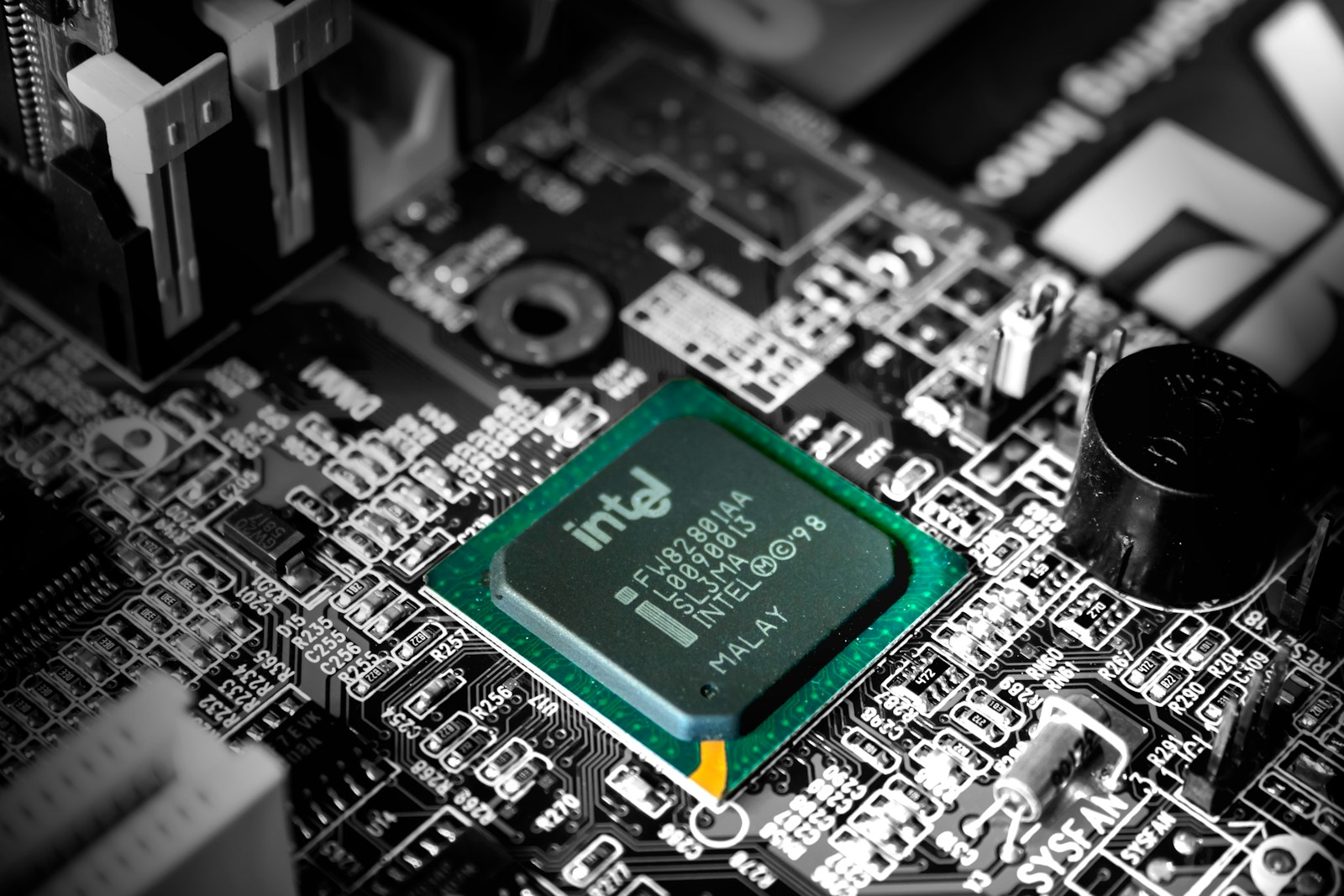

Remember the transformation of the semiconductor market in the 1980s, when the company became the leader, controlling more than 80% of the market. The volume indicator displayed outstanding results. Even at that time, the company’s innovations and rapid growth enticed numerous investors, amplifying its impact on the global economy.