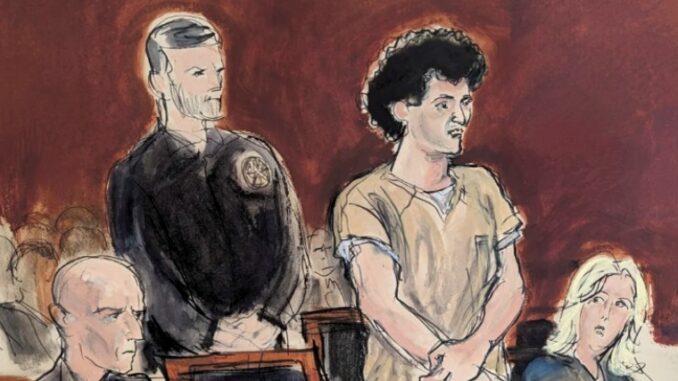

The saga of fallen crypto king Sam Bankman-Fried (aka SBF) reached its pivotal moment nowadays because the disgraced former CEO has been sentenced to 25 years at the back of bars for his position in the epic implosion of FTX.

It’s a downfall tale for the ages – a 31-year-old-antique billionaire who controlled to vaporize billions from clients and investors nearly overnight through some criminally shady enterprise practices. And the choice made it crystal clear SBF’s “brazen” crimes deserve no mercy.

SBF’s Weepy Apology Fails to Impress

The sentencing hearing saw SBF offer up some ultimate-ditch comments, getting all soft about how he “threw all of it away” by tanking his crypto empire. The dude even attempted commending the former business companions who flipped on him, like his shady co-founder Gary Wang and ex-gal friend Caroline Ellison.

But the decision wasn’t having any of SBF’s bulls**t slamming him for never simply expressing “regret” for, you recognize, relentlessly scamming clients out of their hard-earned cash through outright fraud. Ouch!

$11 Billion Forfeiture to (Hopefully) Repay Victims

Apart from the problematic 25-12 months jail stint, the alternative large slam on SBF comes in the shape of a remarkable $11 BILLION forfeiture order from the judge. We’re speaking of seized actual estate, coins, or whatever property the fraudster obtained using FTX clients’ plundered fortunes.

The last aim is to place that recovered loot closer to reimbursing all the evil souls who lost all of it while FTX imploded thanks to SBF’s grimy work. However, bouncing lower back from a disaster of this importance isn’t smooth.

Even the corporate easy-up guy now jogging the FTX financial ruin shredded Bankman-Fried in court docket, saying the dude left the employer in a nation of utter spoiling and insolvency earlier than bailing. Sheesh!

All The Money in The World Can’t Buy Your Way Outta This

At the quiet of the day, at the same time as the 25-year sentence changed into technically less than the lifestyle term prosecutors wanted, it still represents a virtually brutal fall from grace for the notorious SBF, from being the intended “King of Crypto” to facing over two years in the back of bars for being a fraudulent villain.

Sure, SBF became showered with billions upon billions in investor coins during FTX’s meteoric upward thrust. But none of that wealth may want to shield him as soon as his trail of superb deception changed into sooner or later laid bare for all to see. Let this be a lesson to other shady finance bros out there – there may be no money that helps you escape proper justice forever.