You certainly would have planned something for your retirement, but if you are a resident of America, you need to know this. The state in which you reside will surely affect your planning by implying taxes on Social Security.

Where you live will impact your state income taxes. Fortunately, a vast number of states do not levy a tax on Social Security, but 13 do.

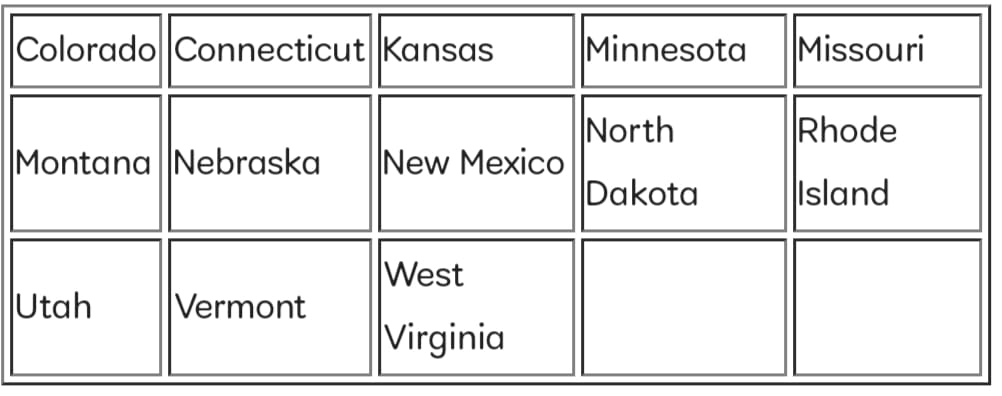

These 13 States are;

So, foresee to pay state taxes on your perks if you live in either of these states. Even if you live in one of the 37 states that often don’t offer tax incentives, you are still liable.

Why is knowing your taxes important?

Social Security perks can save or shatter retiring for many elderly Americans. As per the Social Security System, the average pensioner receives roughly $1,657 per month in payouts, which might be more.

Consequently, depending on the region you live in, you may lose a significant portion of your benefits rates of tax. You may owe income taxes on your Social Security cheques even after you retire. Your benefits may be jeopardized if you stay in one of these 13 states.

Whilst retiring is a big accomplishment to anticipate, it might alter your fiscal position in a variety of ways. As a result, knowing what to consider in terms of taxes is critical.

Even though Social Security is among numerous income streams available to you in retirement, it’s crucial to be aware of the variables that might reduce your benefits, such as state taxes. However, as long as you have that understanding, you should be able to retire in any state you believe would provide the highest overall standard of living.

Reconsider your retirement plans

You might not want to fully disregard these states simply because they tax Social Security benefits. For one reason, some of these states include exclusions that allow you to avoid paying taxes if you make a relatively low income. Even though you may not meet the criteria for exclusion, retiring in one of these 13 states might provide you with other benefits.

Nonetheless, the living expenses in several of these states on this listing are rather modest. Although taxes may reduce some of your advantages, you may be able to flex your Retirement Pay even more by paying much less accommodation and bills.