The COLA, or annual benefit adjustment, is determined by inflation for retired Americans. The boost for this year, which will be revealed on Thursday, is anticipated to be substantial.

The projected cost-of-living adjustment, or COLA, for 2023 is 9.6%, according to the Senior Citizens League. That bump would raise the average retiree benefit of $1,656 by $158.98, according to the organization. Keep up with inflation? pic.twitter.com/NGJ9CIrVtb

— Rico Johnson (@riconcc5) October 8, 2022

COLA 2023

Based on the most recent government inflation statistics, COLA for 2023 is predicted to be roughly 8.7%. When the federal govt releases the inflation data for September on Thursday, the final COLA will also be made public.

There is more good news for Medicare beneficiaries to look forward to Next year, there will be a decrease in the usual Part B premium that is withheld from Social Security benefits.

Social Security's Historic 2023 COLA Comes With a Silver Lininghttps://t.co/sIK2j5D4px https://t.co/8KkSCZCTJL pic.twitter.com/isUk49QaQP

— ✨ 𝑪𝑰𝑵𝑵𝑨𝑴𝑶𝑵𝑮𝑰𝑹𝑳309✨#𝑭𝑩𝒂𝑹𝒎𝒚 (@Cinnamongirl309) October 5, 2022

Over 70 million Americans will receive a sizable increase in benefits next year because of the COLA, one of Social Security’s most useful features. Although the majority of Americans associate Social Security with retirement, the program plays a considerably larger role in ensuring financial security.

Since Social Security is the only universal pension benefit available to all Americans and is almost universally received by seniors, interest in the yearly adjustment is always considerable.

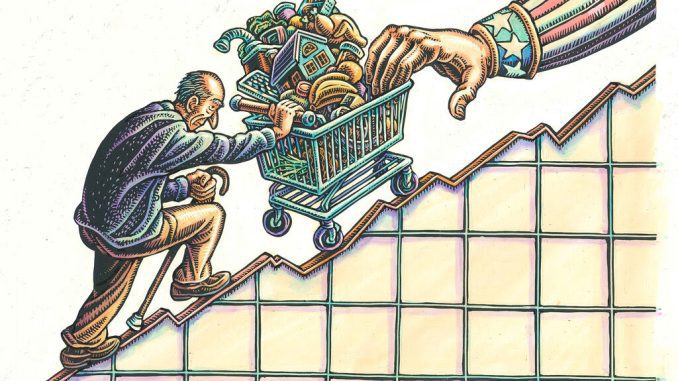

Furthermore, COLA is a key component of Social Security that protects payments from being eroded by rising prices. One of the main concerns of retirees frequently raised in surveys is inflation, and Social Security stands out from other pension payments thanks to the COLA.

For instance, whereas COLAs are a common feature of local and state pension plans, they are typically absent from private sector pension plans.

The COLA Formula

The CPI-W, a comprehensive metric published by the Labor Department that measures price changes for a collection of goods and services purchased by working men and women, not retirees, serves as the foundation for the COLA calculation.

Retirees are affected by inflation differently since they often spend more on housing and health care and less on eats, drinks, and transportation.

Policy experts have discussed ideas to substitute the C.P.I.-W with an alternative index that tries to more precisely represent the inflation that elders experience.

The C.P.I.-E (E is for elderly) has occasionally fluctuated between two-tenths of a % and the C.P.I.-W, which is a significant difference when added up over several years of retirement. The COLA would not always increase as a result of the C.P.I.-E reports The Newyork Times.