Well, it will be a global catastrophe, impacting not only the United States but also countries like Canada, Australia, China, and many others. Whoever is not destroyed by the explosion, will be maimed by the shockwave.

The US economy is on the verge of reaching its debt ceiling since the US government finance policy relies heavily on loans and debt securities such as treasury bonds when it comes to fulfilling government obligations, including payment of tax refunds, military salaries, running social and health insurance programs, and interest payments on existing debt. Accordingly, not only world leaders, but also traders and ordinary people are concerned about the current news background. Politicians watch each other closely to anticipate what may happen, traders keep an eye on the economic calendar to avoid losses, and everyday people worry about safeguarding their savings.

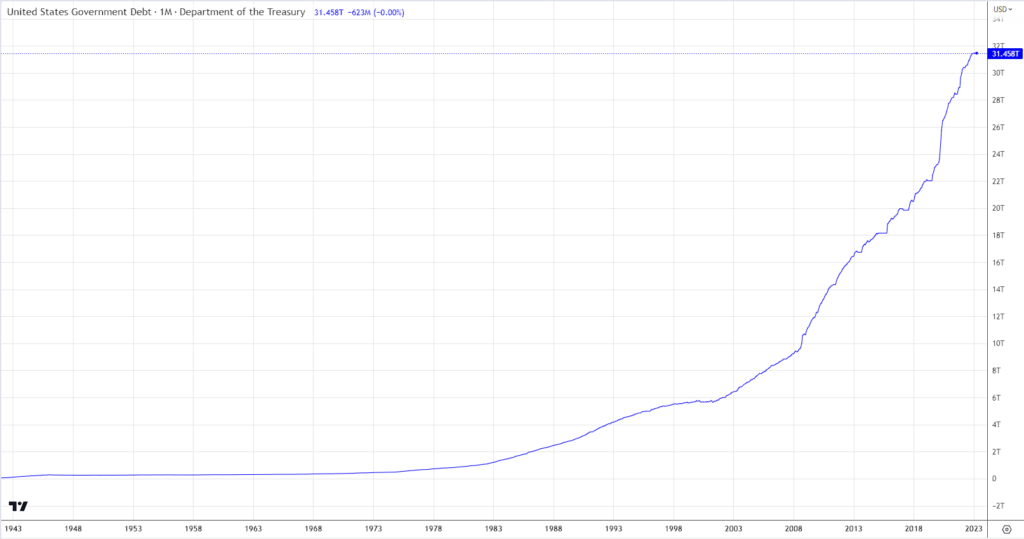

The US national debt hit its maximum possible level of $31.4 trillion at the beginning of this year. The US Treasury warned that the government could lose the ability to meet its debt obligations by June. The Republican-led US House of Representatives has proposed raising the national debt limit by $1.5 trillion in exchange for $4.8 trillion budget cut. That should be enough to prevent the Default for another year, until around the end of March 2024.

At the same time, President Biden is calling on Congress to raise the limit without any conditions, emphasizing that preventing a default is a direct responsibility of Congress.

According to the White House itself, a protracted default will lead to far-reaching repercussions for the US economy. The number of jobs could be reduced by 8.3 million, while GDP will decrease by 6.1% on an annualized basis. Unemployment will increase by 5%, the analysis says. There are opinions that the application by the US President of this amendment to the US Constitution, which allows increasing borrowing without the approval of Congress, could trigger a “constitutional crisis”. But this is parried by the fact that all the same, the state debt limit and budget spending are separate issues and cannot be directly connected.

Thus, the US public debt limit reached $31.4 trillion in January. Treasury Secretary Janet Yellen warned that the government may run out of funds by June 1.

A negative scenario is definitely undesirable. A technical default, or rather, a budget deficit, would not bring the US economy down, given its status as the largest economy in the world, but it would entail a halt in government institutions’ operations due to a lack of funds to pay employee salaries. As for the default on government bonds, this situation might lead to a credit rating downgrade and an outflow of investor funds, causing an increase in rates on them and higher costs to service public debt. Investors are already anticipating these outcomes, leading to a shift in many bonds.

A similar situation occurred in 2011 during conflicts between Democrats and Republicans. Then the US rating was downgraded by one notch. Once the debt ceiling was raised, ratings and markets returned to normal. However, the reasons leading to default will remain, and the US will continue to make new debts to pay off the old ones.

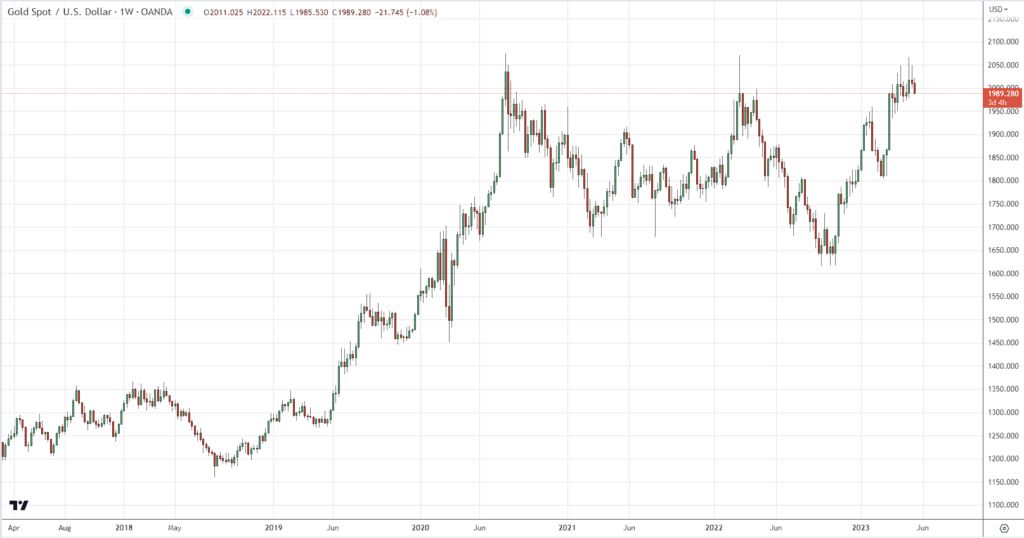

Investors should now tighten up because the clouds are gathering. Until the announcement of the results on changing the upper limit, it is better to avoid trading US government bonds, as well as banks’, insurance and commodity companies’ stocks. Gold, known for its ability to preserve capital during turbulent times, can serve as a safe haven. Oil and other metals are best avoided.

The likelihood of avoiding a default on US government obligations is highly probable. Running a country is not entrusted to the incompetent. Hopefully…

Despite fierce debates and frightening statements made by American politicians and officials, the procedure of raising the national debt ceiling is not something new to the US. Since 1962, the ceiling has been raised 83 times. In the worst-case scenario, the issue of the national debt ceiling could potentially be resolved using drastic measures. President Biden has the authority to declare the debt ceiling unconstitutional, and the US Treasury can simply issue money.

In anticipation of the decision on increasing the public debt, volatility will increase. Now the market seems to ignore the difficulties associated with the public debt increasing.

The US dollar index, as a natural indicator of the state of the economy, unfortunately, or maybe fortunately, is subject to absolutely the same technical principles of movement as other assets. It is worth noting that futures contracts are also traded on the US dollar index.

The index is currently at a significant level that has been both support and resistance on multiple occasions, and it is currently acting as support again. This is a range from 100 to about 104, as evident on the weekly chart. And until this range is broken, there is absolutely no point in looking for support below that level. Usually, if strong levels break through, it leads to a significant shift without much effect that from all the following levels until the price stops for other reasons. And as soon as it halts, it may twitch up and down for some time, until supply and demand reach a certain equilibrium. If a default were to occur, it is highly likely that the index would drop well below 100.

From a resistance perspective, there are a couple of notable levels that could pose challenges for the US dollar’s recovery. These levels are situated around 105-107 and 112-115, representing previous local highs where selling pressure has been significant.

Right now the price has been moving sideways since March of this year, lacking any sharp breakouts. It leads to the conclusion that an accumulation pattern is formed, with key levels defined by the upper edges, middle, and lower boundaries.

Significant forecasts for a probable movement should not be made yet. It is better to exercise patience and wait for clearer signals before making trading decisions. Just like in fishing, it is important to keep an eye on the float and wait for the fish to bite.

Leave a Reply