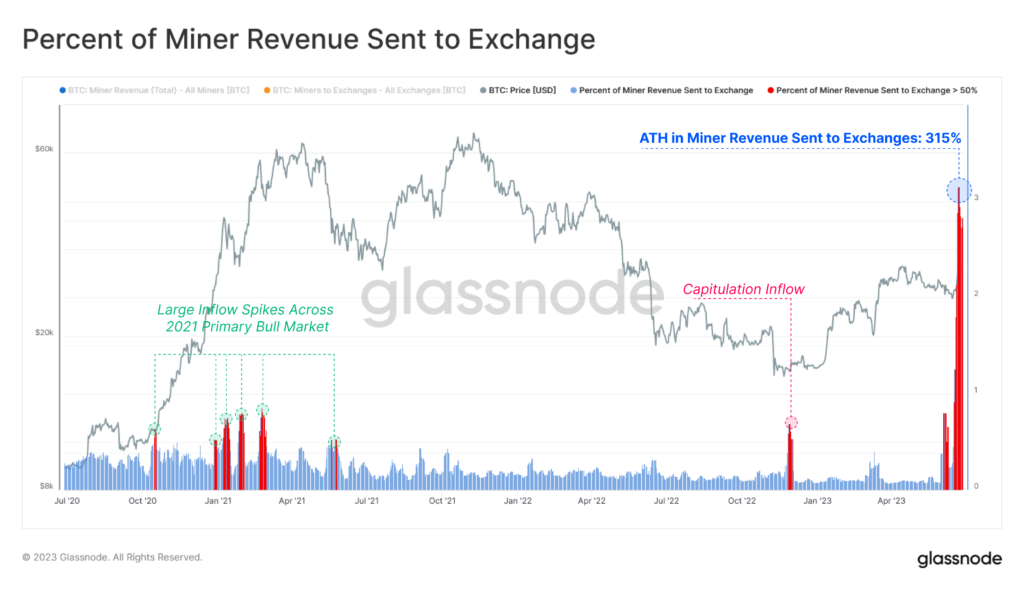

Bitcoin Miners Transfer More Coins to Exchanges Than Ever Before

According to data from CryptoQuant, a blockchain analytics firm, bitcoin miners have been sending unprecedented amounts of their coins to exchanges in the past week. This could indicate that they are taking advantage of the recent price surge and selling their holdings for profit.

The data shows that the Miner Exchange Outflows metric, which tracks the amount of bitcoin transferred from miner wallets to exchange wallets, reached a new all-time high of 29,267 BTC on June 24, 2023. This surpassed the previous record of 26,786 BTC set on March 26, 2020, when the bitcoin price crashed due to the coronavirus pandemic.

The Miner Exchange Outflows metric is considered a bearish signal, as it implies that miners are expecting lower prices in the future and are willing to liquidate their coins. However, some analysts argue that this is not necessarily the case, as miners may have other reasons to move their coins, such as paying for operational costs, diversifying their portfolios, or upgrading their equipment.

Moreover, the Miner Exchange Outflows metric does not account for the amount of bitcoin that is actually sold on the exchanges, as some miners may choose to hold their coins in exchange wallets for convenience or security reasons. Therefore, it is important to look at other indicators, such as the Miner Position Index (MPI), which measures the ratio of bitcoin leaving and entering miner wallets, and the Miner Reserve metric, which tracks the total amount of bitcoin held by miners.

The MPI and the Miner Reserve metrics show that miners are not necessarily selling all their coins on the exchanges. The MPI has been fluctuating around zero in the past week, indicating that miners are not net sellers or buyers of bitcoin. The Miner Reserve metric has also been relatively stable, showing that miners still hold a significant amount of bitcoin in their wallets.

Therefore, it is possible that miners are not dumping their coins on the market, but rather transferring them to exchanges for other purposes. This could mean that they are optimistic about the long-term prospects of bitcoin and are preparing to buy more coins at lower prices if a correction occurs. Alternatively, they could be hedging their risks by converting some of their coins to stablecoins or other cryptocurrencies.

In any case, it is clear that miners have a significant impact on the bitcoin market, as they are the main source of new supply and demand. As such, it is important to monitor their behavior and sentiment, as they can provide valuable insights into the future direction of the price.