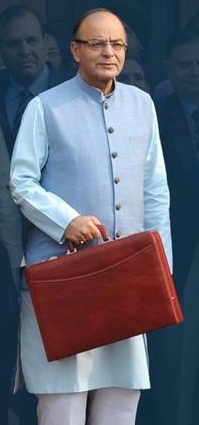

Finance Minister Arun Jaitley has presented his 3rd and challenging Budget on March 03, 2016 and seeks to garner resources for boosting public spending for higher growth.

He finds it tough to balance the needs of the farm sector and industry. Talking about the income tax, the Budget 2016 continues with status quo on tax slabs and might tinker with exemptions.

The finance minister has the pressure of spending more on social schemes owing to rising rural distress which is a result of back-to-back droughts. At the same time, his duty is winning back foreign investor for effective reforms.

The difficulties have further been compounded by a huge 1.02 lakh crore that has to be paid out owing to recommendations of 7th Pay Commission for government employees.

Jaitley would also fulfill his promise made last year that corporate tax would gradually be reduced from 30 percent to 25 percent gradually over four years.

Jaitley would also fulfill his promise made last year that corporate tax would gradually be reduced from 30 percent to 25 percent gradually over four years.

It is expected that the exercise in the Budget would start on Monday and along with that tax exemptions would be withdrawn for keeping the exercise revenue neutral.

For shoring up income for meeting increased expenditure, an increase in indirect tax rates is needed. Last year the service tax that was raised to 14.5 percent might hike for preparing for the level of 18 percent.

Further, there are speculations of funding initiatives such as Digital India or Start-up India. Even the investment cycle would be revived on this agenda.

While there is a 25.5 percent increase in the capital expenditure over the last year, the GDP percentage is still stuck at 1.7 percent and needs to be up by 2 percent.

We need to steer spending in various sectors like infrastructure and raise public spending for not picking up the desired pace.

Some highlights include:

Deviation of government from RBI’s stance and liberal spending for infra and agricultural sectors

Allocation of more funds to farm sector and to focus on increasing the yield of crops

Exemption from paying service tax for constructing ports

[pdf-embedder url=”https://www.panasiabiz.com/wp-content/uploads/2016/03/Budget-2016.pdf”]

Owing to fall in crude prices, customs duty might be reintroduced by the government on imported diesel, petrol and crude.

Import duty on gold might also be increased since imports of gold have been increased over the year.