North Korea Shatters Records With $2 Billion Crypto Theft — Total Now $6.75 Billion

On December 18, 2025, new data revealed that North Korea has driven a record-breaking $2.02 billion in cryptocurrency theft this year, pushing its all-time total […]

On December 18, 2025, new data revealed that North Korea has driven a record-breaking $2.02 billion in cryptocurrency theft this year, pushing its all-time total […]

On December 18, 2025, T-Series released the lyrical video of “Oru Pere Varalaaru,” the second single from the upcoming Tamil film “Jana Nayagan,” starring Thalapathy […]

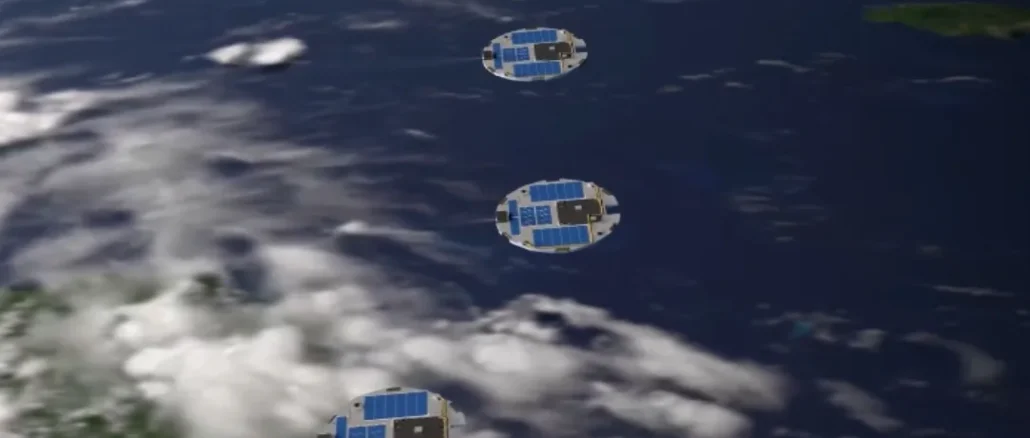

On December 18, 2025, NASA confirmed that its innovative DiskSat spacecraft is gearing up for launch into low Earth orbit, marking a major milestone in […]

Morning sunlight exposure is one of the most powerful natural ways to boost vitamin D levels, improve mood, and support long‑term health. Just a few […]

On December 18, 2025, the Powerball jackpot surged to a massive $1.5 billion, marking the seventh-largest lottery prize in U.S. history. The spike came after […]

This Bold Telugu Film ‘Santhana Prapthirasthu’ Is Finally Coming to OTT

On December 18, 2025, the spirit of “Spreading Smiles & Compassion” came alive as Lt Gen AVS Rathee, GOC Konark Corps, and Mrs. Rajnie Rathee, […]

On December 17, 2025, OnePlus officially unveiled the OnePlus 15R in India, giving buyers a powerful new flagship option with top-tier performance and premium features. […]

A growing pile of domestic and construction waste at the entrance of Hubballi city on Kusugal Road has become a major civic concern, with residents […]

New Delhi — The Indian Rupee (INR) fell to a record low on Monday, touching ₹90.74 per US dollar, as the ongoing lack of agreement […]

InCommon, Global Capability Centers (GCCs), has unveiled its GCC Tier 2 Report 2025, highlighting the growing momentum of GCCs in India’s Tier-2 cities and their […]

On December 18, 2025, new data revealed that North Korea has driven a record-breaking $2.02 billion in cryptocurrency theft this year, pushing its all-time total […]

On December 18, 2025, the Powerball jackpot surged to a massive $1.5 billion, marking the seventh-largest lottery prize in U.S. history. The spike came after […]

On December 18, 2025, Italian cricket faced a major shake-up as the board confirmed that captain Joe Burns has been axed ahead of the Men’s […]

On December 17, 2025, cricket fans will witness a high‑stakes clash as India takes on South Africa in the 4th T20I at the Bharat Ratna […]

Indian captain Suryakumar Yadav won the toss and chose to bowl first in the third T20 against South Africa, being played at Dharamsala on December […]

Indian cricket star Hardik Pandya has quietly taken a major step off the field. In a recent social media post, the all-rounder announced the launch […]

On December 18, 2025, fresh leaks revealed that Apple’s upcoming foldable iPhone may feature an iPad mini-like design, sparking major excitement among tech enthusiasts. Early […]

On December 17, 2025, Google Labs announced a new experimental AI productivity agent called CC, designed to deliver a personalized “Your Day Ahead” briefing directly […]

On December 17, 2025, OnePlus officially unveiled the OnePlus 15R in India, giving buyers a powerful new flagship option with top-tier performance and premium features. […]

Mountain View — Google Cloud has unveiled a major networking upgrade for its AI Hypercomputer platform, introducing NCCL/gIB, an enhanced version of NVIDIA’s NCCL designed […]

A new report has revealed that alleged members of the Chinese state-backed hacking group known as Salt Typhoon may have once participated in Cisco’s official […]

On December 18, 2025, new data revealed that North Korea has driven a record-breaking $2.02 billion in cryptocurrency theft this year, pushing its all-time total […]

New Delhi — The Indian Rupee (INR) fell to a record low on Monday, touching ₹90.74 per US dollar, as the ongoing lack of agreement […]

Bangkok, December 4, 2025: Thai authorities have uncovered a massive cryptocurrency scandal after raiding seven bitcoin mines worth an estimated B300 million. Officials revealed that […]

On December 3, 2025, the Indian rupee breached the psychological barrier of 90 against the U.S. dollar, slipping to a record intra-day low of 90.15 […]

Beijing, December 1, 2025 — China has once again declared war on cryptocurrency, with the People’s Bank of China (PBoC) intensifying its crackdown on digital […]

On December 18, 2025, the Powerball jackpot surged to a massive $1.5 billion, marking the seventh-largest lottery prize in U.S. history. The spike came after […]

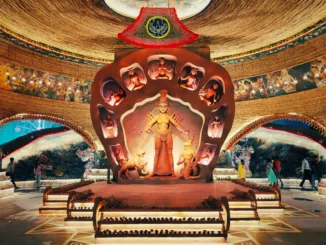

Ayodhya’s Festival of Lights Shines with Record-Breaking Diyas On October 19, 2025, Ayodhya became a dazzling spectacle as Deepotsav 2025 illuminated the Saryu River’s banks. […]

Diwali 2025 is just around the corner, and millions across India and the world are preparing to celebrate the festival of lights with grandeur. But […]

On the auspicious occasion of Maha Ashtami, one of the most important days of Durga Puja, devotees gathered at the Babubagan Sarbojanin Durgatsava Committee pandal […]

Navaratri, meaning “nine nights,” is one of the most sacred festivals in Sanatan Dharma, dedicated to the worship of Goddess Durga in her nine divine […]

Navaratri 2025 kicked off on September 22 with vibrant rituals and digital devotion. Across India, families are observing Ghatasthapana, the ceremonial installation of the kalash, […]

Copyright © 2025 | WordPress Theme by MH Themes