Since its inception in 2015, Ethereum (ETHUSD) has attracted significant attention in the world of cryptocurrency, emerging as the second-largest digital currency by market capitalization, following Bitcoin. Many companies have been trying to issue ETFs for both Bitcoin and Ethereum for several years. However, the approval process for such funds is complex, as regulators like the U.S. Securities and Exchange Commission (SEC) approach cryptocurrencies with caution due to concerns regarding market manipulation, volatility, and asset storage reliability.

An ETF (Exchange-Traded Fund) is an investment fund traded on an exchange, mirroring asset or index prices and functioning much like stocks. In the context of Ethereum, an ETF would enable investors to invest in ETH without directly purchasing and managing cryptocurrency. This simplifies investing in Ethereum, broadening its accessibility to a broader investor base, including institutional players.

The first efforts to establish ETFs based on cryptocurrencies began in the early 2020s, but most encountered rejection or postponement. However, in October 2021, the first Bitcoin ETF was introduced in the United States, marking a significant milestone for the crypto market and signaling the increasing recognition of cryptocurrencies as a legitimate investment asset class. As of early 2024, the approval process for an Ethereum ETF remained underway, encountering challenges and hurdles similar to those seen with Bitcoin ETFs.

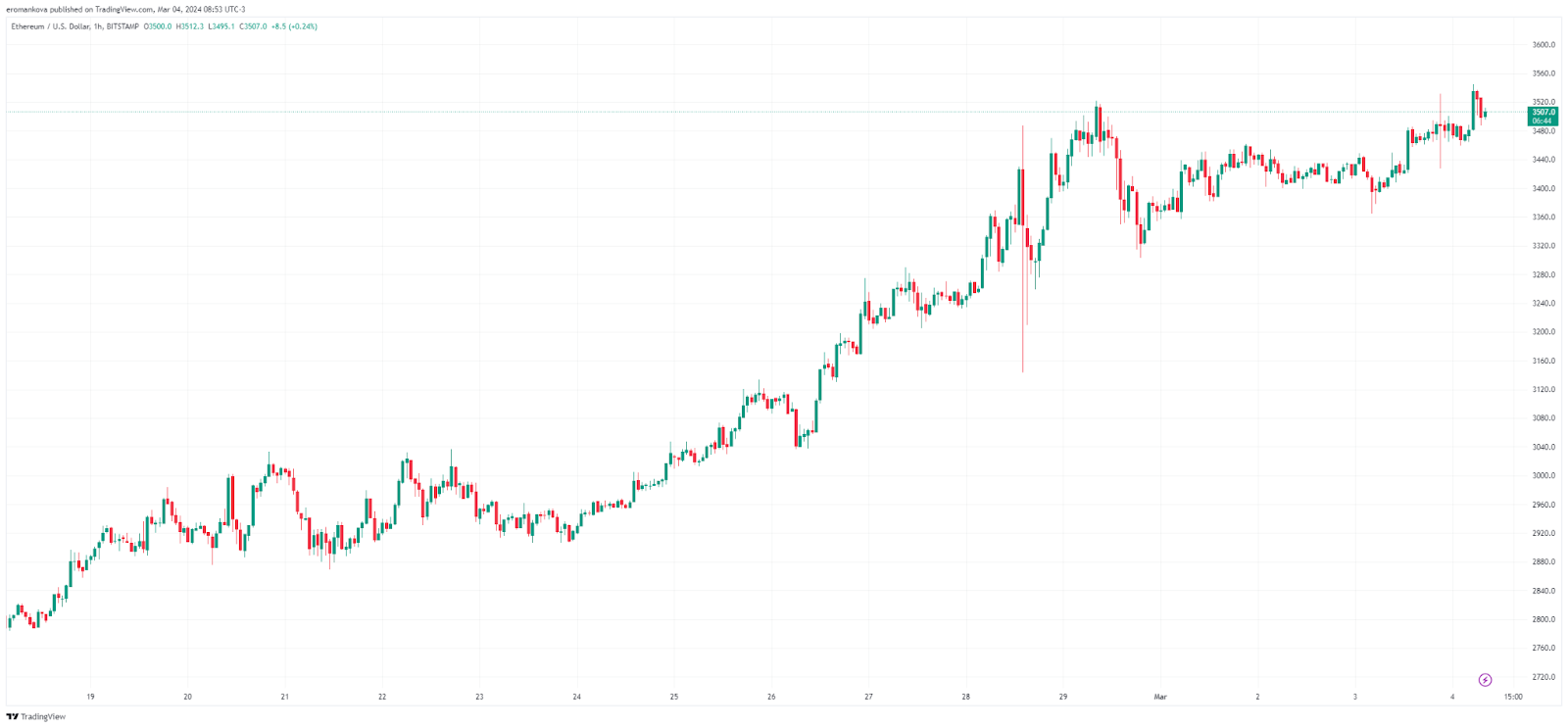

Despite numerous applications and investor interest, the Ethereum ETF has yet to secure approval from key regulators. Nonetheless, the possibility of SEC approval for spot exchange-traded funds tied to Ethereum has bolstered the attractiveness of the second-largest cryptocurrency among investors. The cryptocurrency’s token price surpassed $3000 on February 20 for the first time since April 2022. The price has remained above this resistance level, with the next significant resistance levels anticipated at $3590-$3980. Once these levels are reached, a correction for further growth may ensue, with the depth of the correction contingent upon subsequent price formations.

The potential approval of an Ethereum ETF could significantly impact the ETH exchange rate and the broader altcoin market, primarily through increased capital inflows. ETFs enhance investment accessibility, allowing investors to buy shares through traditional brokerage accounts without resorting to cryptocurrency exchanges. This accessibility could drive more capital inflows into ETH. Moreover, the entry of institutional investors can also stabilize the price of ETH, given their inclination towards long-term investments and reduced involvement in speculative activities.

A successful launch of the Ethereum ETF could stimulate interest in other cryptocurrencies as investors become more confident in the crypto market and seek additional diversification opportunities. In the long run, ETF approval could fuel sustained ETH price growth through heightened institutional demand and broader acknowledgment of Ethereum as an investment asset. Market participants expect Ethereum ETFs to be the next in line for approval by U.S. regulators, potentially amplifying ETH’s appeal among more conservative institutional investors, akin to the massive funding raised by the first Bitcoin ETFs.

However, it’s crucial to recognize that while the advent of the Ethereum ETF may open up new horizons for Ethereum, it can also potentially increase the correlation of cryptocurrencies with traditional financial markets. This could make the ETH rate more sensitive to general economic cycles and fluctuations in the market.